a) Leaders Lead…in Both Directions

Recent Strategy Sessions have focused on the ominous signs being flashed by the leading parts of the market, even as the S&P 500 Index and Dow Jones Industrial Average printed fresh all-time highs. Those warning signs began to manifest themselves in an even more pronounced manner last week, as the selling intensified in leading, high growth issues, such as biotechnology stocks, AMZN FB GOOG LNKD NFLX PCLN YELP, and small caps. This was all happening as the Dow and S&P hit new all-time highs on Friday morning, via an opening gap higher after the jobs reports.

As I noted last weekend, we have seen a shocking amount of opening gaps higher in the broad market over the past two weeks only to see the heart of regular cash session hours feature lethargic price action, at best, if not outright corrective or even bearish action in the leaders. Indeed, corrective or bearish markets tend to open strong and close weak, as large, institutional players unload their long inventory into unsuspecting retail players who buy into the opening strength.

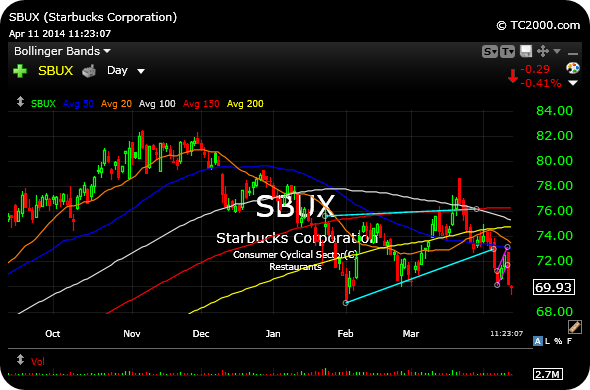

Another hallmark of a new trend lower, or the early stages of a deep correction, is that leading stocks become oversold and then subsequently remain stubbornly oversold for quite some time. This is the flip side of the bullish roadmap we have previously used to determine a new bull market or fresh, healthy uptrend, where price becomes overbought in the leaders and seemingly defies gravity for quite some time before the inevitable, contained, and buyable pullback sets in.

Recall that leaders lead in both directions. Hence, the heavy selling of late in the liquid, marquee issues in the biotechs, small caps, and glamorous Nasdaq should continue to be taken very seriously as a potential sign of a major, new change in trend, or the early-stages of a much deeper bull market correction than we have seen in years.

b) Not as Bloody as You May Think, Just Yet

Another issue to consider is whether the market is, in fact, even currently oversold. The answer may surprise you, even for some of the more battered and bruised indices of late.

According to the NYSE McClellan Oscillator (“NYMO”), which is a simple market breadth indicator tool, we are not yet technically oversold anywhere close to the point where “buying the blood” is typically justified.

Generally speaking, when NYMO is above zero it tends to indicate bullishness for stocks, and below zero, bearishness. However, extreme readings can indicate overbought or oversold conditions. Above 50 is considered to be overbought, while below -50 is considered oversold.

Updating the NYMO daily chart, you can see we closed last week out at -10.35, bearish and not in oversold territory. In fact, NYMO actually closed a fraction higher than last week. Hence, the notion of buying the blood in the streets may be a bit premature here. Another sharp down day or two early this week, however, can easily see NYMO plunging into classic oversold territory.

c) The Split Market May Be Coming Together as a Whole

A major reason for the lack of oversold readings for the broad market, denoted by the NYMO analysis above, is, of course, the resilience of the S&P 500 and Dow Jones Industrial Average. Bulls have correctly been pointing out the recent rotations into these indices. However, the more pertinent issue for traders became how sustainable these capital rotations were.

On the weekly S&P 500 Index chart, note the long-running bearish RSI divergence to price at each all-time high since late-2013.

For reference, the RSI is simply the “Relative Strength Index” used to identify changes in technical momentum. Above 50 is generally considered a bullish RSI, with above 70 viewed as overbought. Trending below 50 is considered a bearish RSI pattern, with below 30 considered oversold.

Here, the RSI has been trending lower as price made fresh highs for months on end. This circumstance indicates that buyers are growing weaker with each subsequent thrust higher in price, in terms of their upside momentum.

Given that these negative divergences have been building for so long, we should combine that fact with the glaring weakness in the leading parts of the market. Fused together, this is even more reason to be skeptical of a sustainable rotation into the S&P.

Simply put, even the strongest indices of late have long-running bearish divergences of their own to reconcile.

And turning to the aforementioned Nasdaq and Russell…