I recognize that homebuilders and financials have been/are popular sectors mentioned in terms of being rotation beneficiaries for the bull going forward. But I have to believe that the major casinos will telegraph whether the broad market can sustain these levels, over 1800 on the S&P 500 Index, in the coming weeks and perhaps months.

I retain a small position in a WYNN long, inside 12631, from a $167.80 entry last week.

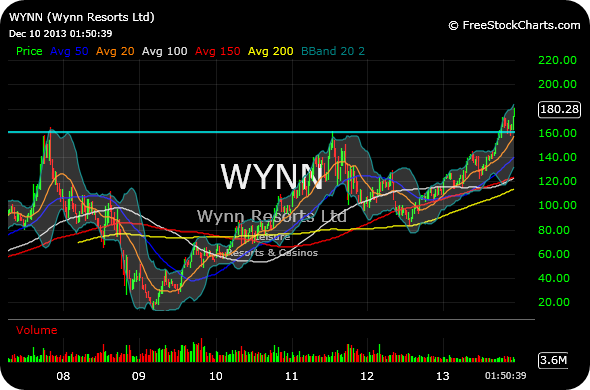

When we look at the weekly chart for Steve Wynn’s eponymous high class resort/casino empire, you can clearly see how prior 2007 and 2011 highs have been negotiated by buyers.

That $161-$164 area had better hold as support. But a case for a move up towards $200 is not an implausible one now. Sure, you can also argue a massive cup and handle dating back six years.

Similar comments apply to LVS MPEL, even MGM.

It would not be an “easy money” asset bubble with casinos roaring, right? Also, legalized online gambling is will soon be available in every state in the Union–Get used to grandma (and your college kids) gambling all day…

See my top prediction for 2013, posted in December 2012 here.

__________________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

Mazel on a good trade. I missed my love, LVS.

Thanks….Thinking we will get secondary entry points soon. Enjoy the Santana song.