The CORN chart we looked at yesterday is seeing some nice upside follow-through (for once), as reader “gatorsun”‘s idea of long CORN is off to a promising start.

As far as the broad market this afternoon, we are seeing an overall anemic bounce attempt, which is not a good sign given that we were already short-term oversold. There are some select stocks giving good action, but momentum is far from healthy here, in my view.

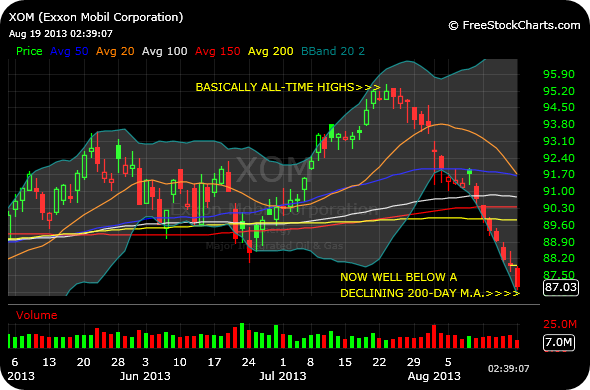

Perhaps the most concerning chart I see out there, beyond the homebuilders, is energy giant Exxon Mobil, with its $383 billion market cap.

Here we have a stock which made basically all-time highs (or pennies just below the 2008 high during the crude super-spike). Now, just a few weeks later, the stock is below its declining 200-day moving average and cannot muster much of a bounce, if at all.

If that does not qualify as a bull trap, I am not sure what does.

_______________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice find on this one! Feels telling…

Yeah $XOM hasn’t been the same since earnings. Another Dow component name that is breaking down and no buzz is $T. Four Dow stocks in death cross mode (AA,IBM,CAT,T) will it start spreading to others is the big question for now.