…That is the headline that the bears want you to believe, but is also one which makes bulls’ blood boil. (And its the headline Chess uses on a slow, summer Monday)

So, let’s take an objective look at what is really happening here. I should add that it is still up for debate just how correlated stocks and bonds are these days.

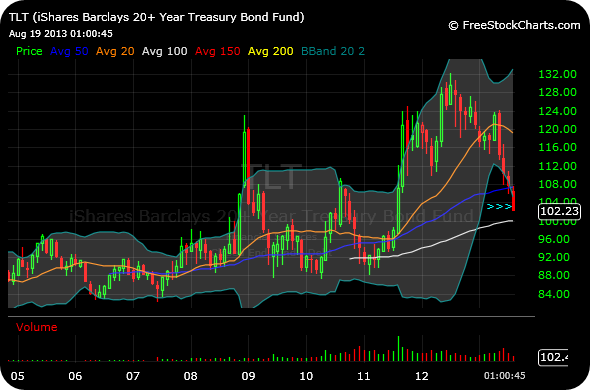

The inability of Treasuries to bounce remains a concern, especially given that TLT is clearly well down below its lower monthly chart Bollinger Band (first chart, below). History tells us that crashes are incredibly rare, but when they do happen, they tend to happen from very oversold conditions where a bounce is unable to materialize.

My interpretation here, based on the daily chart, second below, is that Treasuries are in the final stage of capitulating during their first stage of confirming the monthly chart head and shoulders top, dating back to 2012. I do not see a trade just yet. But we are getting close to a snapback.

What’s your take on the bond market here?

___________________________________________

___________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

From a few posts back

…nicely done on MRO Chess.

That thing wasted no time in slicing the 200-day m.a.. Very heavy selling volume.

Looking at TBT weekly, long from 69.5 break back in June – A snapback would make sense, given how stretched it is, perhaps after a blowout ride up or as you say capitulation for TLT…the weekly avg’s are turning up too and will act as support re TBT

http://screencast.com/t/CiyoYYYM

Nice, thank you.

I agree Chess. Just looking for a reversal day in TLT to get long.

Yep

CORN…right on Chess…working well

Good play, gator.

Buy the TLT…like now

TMF = 3x

I’ve been waiting (and waiting, and waiting) in vain for a bit of a recovery in bonds to sell some long term positions in my 401k’s. Hasn’t happened at all.

My guess is the best explanation is foreign central bank selling is the largest factor driving the bond market. Both Chinese and Japanese banks are net sellers, I believe. And both have a reputation for being price insensitive buyers and sellers. If true, they will continue to sell even as bonds get more oversold. There just might be no oversold bounce until they’ve unloaded whatever they want.

I forgot to say they are price insensitive because the transactions are for political (i.e, currency or trade), not economic (making a profit), reasons.