Regardless of whether or not you view it as an imminent contrarian signal, there is little doubt that certain indicators are reaching extreme levels. Obviously, if you went all-in long on TSLA or GMCR before earnings then you probably could not care less about this stuff. But generally speaking the market has been gappy, whippy, and a a bit more selective than you might expect when the major averages are pushing one all-time high after the next. That need not mean we go out and call a major top. But it does mean that playing things close to the vest is not incorrect.

To support this notion of extremes, Downtown Josh Brown had a piece up today walking you through two of them, in particular.

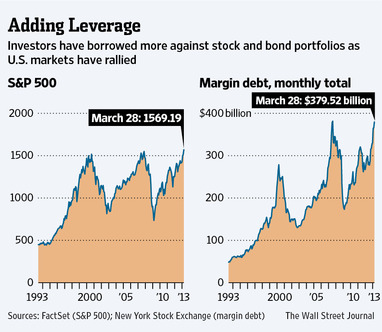

let’s just acknowledge the fact that margin debt is reaching extreme levels and just think about it psychologically – we don’t have to have a debate about whether or not this is an actionable signal.

Here’s the WSJ:

As of the end of March, the most recent data available, investors had $379.5 billion of margin debt at New York Stock Exchange member firms, according to the Big Board.

That is just shy of the record $381.4 billion in margin debt set in July 2007.

In March, the level of margin debt stood 28% higher than one year earlier, a time frame that saw the Standard & Poor’s 500-stock index rise 11.4%.

The fear is that as more investors rely on money borrowed against stocks, any significant fall in stock prices will be magnified if investors are forced to sell securities to raise cash and meet margin requirements.

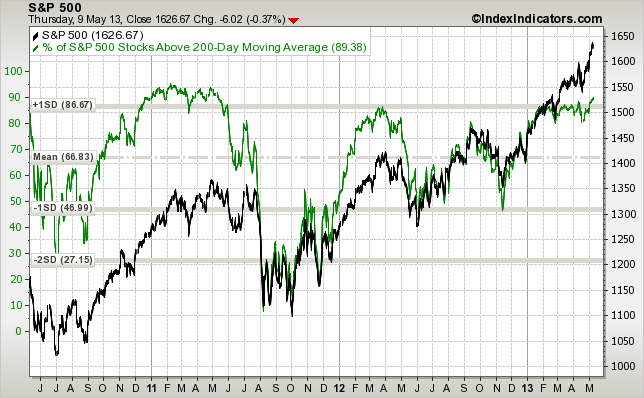

And then let’s briefly mention the extremes in market internals – a whopping 89% of the S&P 500 sits above its 200-day moving average. Again, let’s just be aware of this, we don’t have to debate it as a timing mechanism:

What I want to get across is that risk appetites are almost on full-blast.

READ FULL POST HERE

If you enjoy the content at iBankCoin, please follow us on Twitter