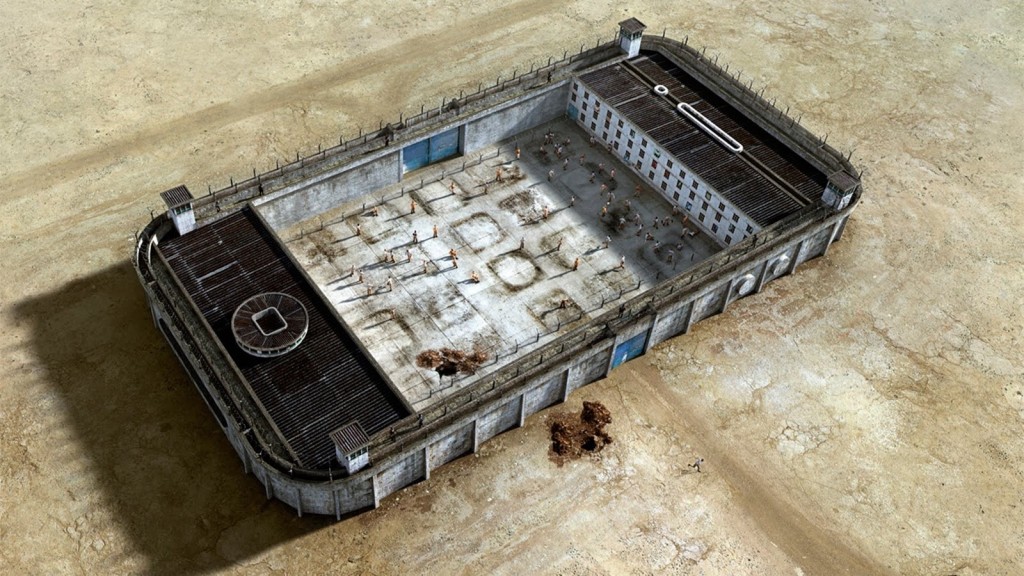

At the beginning of 2013, there was a general feeling that the broad market would be unable to form a sustained leg higher unless Apple found a bottom to its correction which began in September 2012. Several months later, the consensus seemed to have flipped on its head, as many now argued that the market at-large might not top out until Apple found a bottom. With the price action this week, especially, in both Apple and the broad market, you can see the value in avoiding ubiquitous dogmas. In other words, both Apple and the broad market continue to stupefy traders stuck in their own self-imprisoned thoughts–The market did indeed rise for months on end even as Apple pushed lower. And now both the market and Apple are correcting in unison.

Applying that line of thinking to other potential dogmas down the road, consider the notion that the current March 2009-present bull market will not end until and unless The Fed begins to tighten, with Chairman Bernanke finally taking away the “punch bowl.” That type of thinking leads to stubborn complacency, much like we saw in the end of 2007 and even throughout parts of 2008 as the technicals of the market obviously weakened, yet traders who previously prospered under “Easy Al” Greenspan at The Fed were convinced stock prices were simply incapable of falling into a deep bear market.

Also consider the notion–one which I have thought as a near-certainty myself–that the market simply cannot form a major, multi-year top until we see investor sentiment reach the euphoric stage where greed is bordering on the absurd. As you may know by now, sentiment continues to be highly skeptical of this hated rally. Nonetheless, that is simply part and parcel of a maturing secular bear market. Low volume rallies, high volume sell-offs, selective leadership, they were all characteristics of the late-1970’s during the 1966-1982 secular bear, not to mention the latter years of the 1929-1944 secular bear. Investors lost confidence in the market as a general proposition, regardless of cyclical rallies. So, perhaps reaching the greed phase this time around is not in the cards in order for the market to top?

You might also consider the price action in the consumer staples, crude oil, natural gas, Treasuries, etc., and examine the self-imprisoned thoughts embedded in each of those assets and their recent performances along with the current conventional wisdom, before choosing to avoid getting trapped in them and analyzing the market actually before your eyes, as it unfolds.

If you enjoy the content at iBankCoin, please follow us on Twitter

“Cool Hand Chess”–nice post.

Wouldn’t the rise of dark pool trading explain why volume has declined so much on the exchanges over the past few years? The exchanges are not receiving those orders anymore, so they are not able to report the actual volume running through it. Instead dark pools are just matching orders on their own.

Really great post.

Thanks, Erik!

I was looking at this, as well as your intermarket work. Looks like we are looking at a lot of similar things. I have applied a lot of intermarket relationships, would be happy to hear your thoughts! http://seekingalpha.com/article/1344071-5-reasons-why-i-am-shorting-the-market

As well, any suggestions where I can further read into past secular bears regarding sentiment and what not?

thanks, Brennan. Here you go: http://ibankcoin.com/chessnwine/2013/01/14/giving-the-secularists-some-religion/