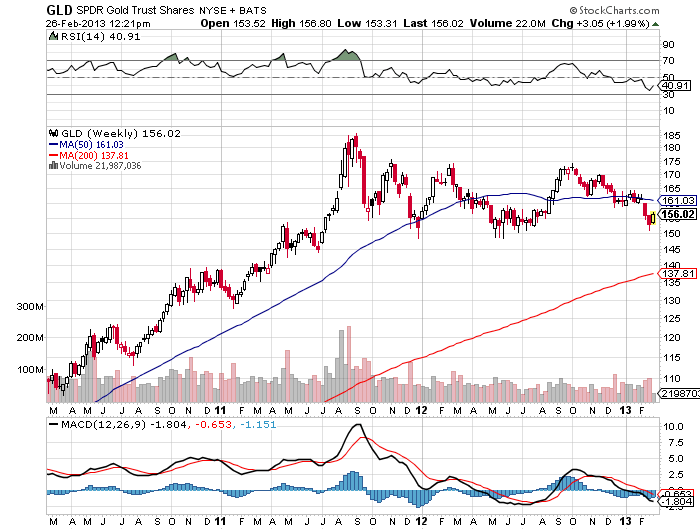

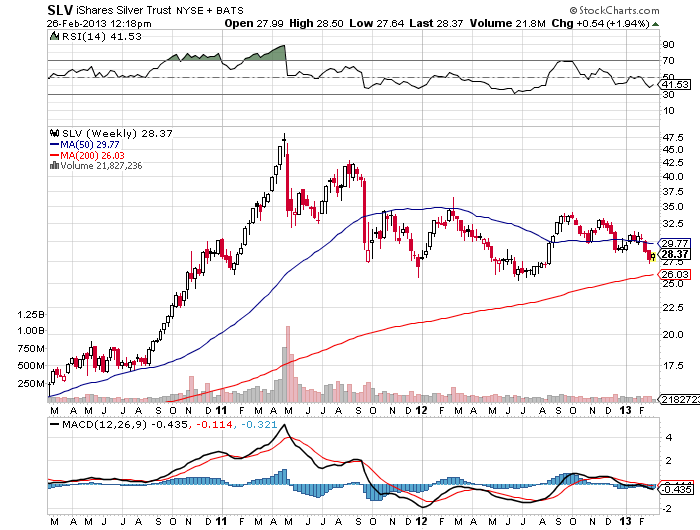

Gold and silver are bouncing from recent oversold conditions. They had originally meagerly bounced sideways for a few days, setting up the possibility for a bear flag break lower. However, the past two days have seen the metals (miners, too) pushing higher as equities sold off. Still, we are talking about broken charts here, with sloppy action, entangled moving averages and declining or flattening 50 and 200-day moving averages.

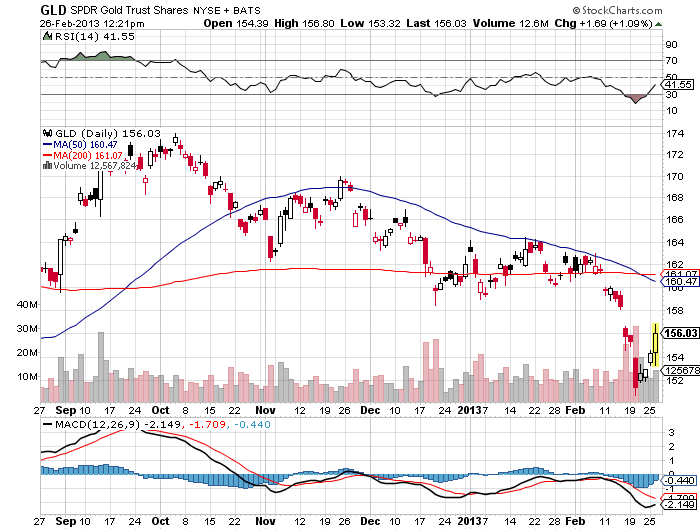

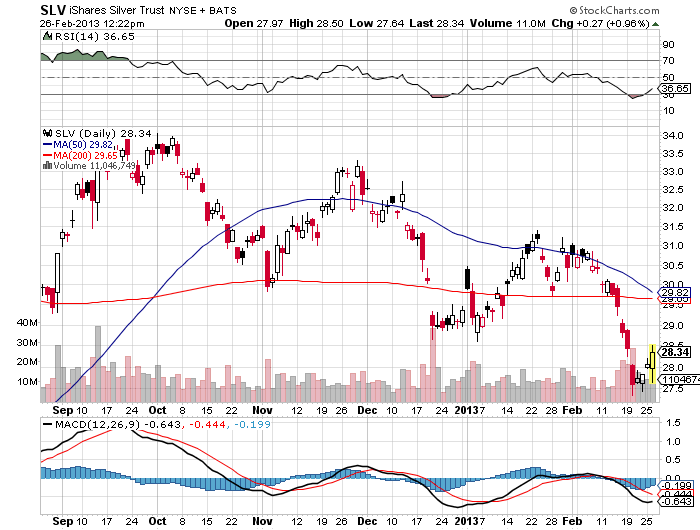

Although it is very easy to look at the past two days of price action and think what a no-brainer it was to get levered long for a simple reflex rally, in reality there have been plenty of times with similar setups where more carnage ensued, particularly when the initial bounce was so anemic. Even with the bounce the past two days in the metals, the first daily charts below of the gold and silver ETF’s, respectively, illustrate oversold conditions (daily RSI on top pane below 30) being alleviated, with no bullish divergences. Even though the tight bear flags have become more amorphous, the distinct possibility of a rollover exists.

Supporting that notion are the weekly charts after, which show neither gold nor silver has hit oversold weekly RSI despite the recent swoon.

_________________________________________

_________________________________________

_________________________________________

_________________________________________

If you enjoy the content at iBankCoin, please follow us on Twitter

A lot that has been said lately about gold as an investment seems to be just noise. Long term I tend to agree with Ray Dalio’s view that gold is simply an alternate currency that big players intend on accumulating over time as this era of deleveraging and CB monetization continues. His thoughts on the subject appear at around 11:00. I know your a technical guy Chess but do you have any thoughts on this idea? http://video.cnbc.com/gallery/?video=3000142389

Good points, Chess.

Middle of last year I started counting the times gold/silver/miners “should” be a buy based on divergences, key reversals, multi-year bad sentiment, things that worked before. At least 5 times we should have rallied – but we’d get a few good days and then roll over again. I can also count many posts on various blogs predicting gold would completely break down, but it ended up squeaking out a rise. Very tough to trade either short or long.