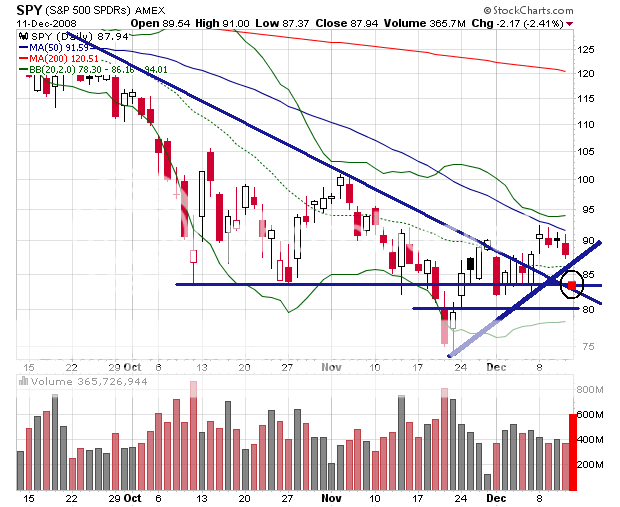

Finally…some direction in the market. I didn’t expect the market to extend so far into the close. I know this tight range has been pissing a lot of people off. We accomplished several things today that are very important:

1) We broke out of the narrow range and formed a Rising Five Method, a knock off of the Rising Three Method (I don’t know if that secondary continuation pattern exists, but I just gave a name for it).

2) Today’s volume exceeded the volume levels for the past five days. However, it’s nowhere near the breakout levels that I wished to see. The volume must be maintained in subsequent days. I do not want to see a fall off in volume.

3) We re-entered the 880-920 range after having threatened to breakdown the past 2 days. This is considered a neutral move, but more bullish for today’s action.

4) We are above the 50-day MA on all three indices. The SPX and DJIA are clearly above while the COMP is 2 points above the 50-day MA. However, just because we closed above it doesn’t mean that it gets easier from here. There needs to be incoming momentum to fuel this rally or it’s dead.

5) The ascending wedge (COMP) and the ascending triangles (SPX, DJIA) now have the highest chances of breaking out (920+ SPX) to the upside. As long as the market doesn’t drop -2.5% or more, the bulls should be ok.

6) Financials led the rally. The banks were the big buys today. (3:09PM – Add 25% financial longs order issued). Of course, they’re going to benefit the most from the Fed’s actions, now and in the future. The 2nd best sector was the industrial/materials sector combo.

Some Concerns:

1) Oil lagged. I’d like to see oil move in tandem with the market to support the rally. A further decline in oil will obviously impact the strength of the rally. Massive volume spikes the past several days suggests that a decline in oil may come to a short-term halt.

2) This is still a bear market rally. Don’t get caught with your pants down.

Interesting. You know how CNBC started those “I am CNBC” self-promotion commercials? Well, as I write this, I heard that Melissa Francis is a “a Harvard grad…an anchor…a frustrated hip-hop artist?”. Please. That’s ridiculous.

In other news, I think Rebecca Jarvis looks like this warrior elf:

Similar?

Anyway, the possibility of a pullback to 902 or even as far as 882 on the SPX is possible. If we break above 920, we would have cleared almost every major resistance level until 950. Looking at the 10-day chart, we can see that the SPX is sitting right on near-term support at 910. I have no idea what to do until I see the first 15-30 mins of the open. If we get a major gap up or down, that could change my assessment.

The bottomline is that a move like this cannot be ignored. This was obviously a powerful move and technically pleasing to my eyes. This could be the beginning of a measured move up. Don’t forget that we have earnings from MS, CAG, GIS, CMC, JOYG, APOG, NKE, PAYX, TTWO, and a few others. Before we get too excited, keep in mind that the auto bailout has not yet been resolved.

Support levels for the SPX are 909, 905, and 887-900. Near-term resistance is at 920, which will be tough to crack. Enjoy the rally, but be ready to bail if things look bad. This is still a short-term trader’s market. Remain flexible, or you will lose money and end this year empty-handed. Not good for the Christmas spirit.

SPX 1-day

SPX 3-day

SPX 5-day

SPX 10-day

SPX 6-month

Comments »