Ultramarines Space Marine Chapter preparing for the First Battle of Armageddon

—

This article will attempt to explain what I look for, the best setups to short, how to short using MAs and other technical basics dealing with short selling. Short selling is for intermediate and expert traders and I do not encourage beginners to jump into shorting stocks, especially if you are the type that likes to hold onto losing positions. Treat this only as an educational article since I am not providing any legal or financial advice.

There are numerous patterns that one can search, however, I focus on 7 primary setups for shorts (If you read my article on long patterns, there were also 7 patterns). The patterns are as follows:

—Patterns—

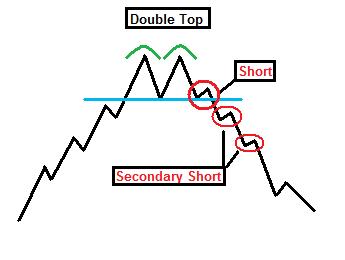

1) Double Top:

The double top formation takes several weeks or months to develop. It’s a reversal pattern that stops an extended uptrend. The 2nd top is unable to make a new high and threatens to breakdown from the neckline, which is the nearest support for both peaks. The idea short entry is either early on the breakdown or on the flag (if develops at the neckline). There are several secondary entry points in case you miss the first.

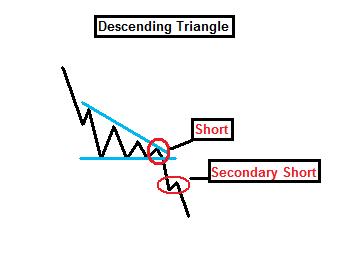

2) Descending Triangle:

The descending triangle is an easy pattern to find. This triangle holds horizontal support, but continues to make lower highs, creating a downtrend. The ideal entry is to enter before the triangle breaks since the breakdown is usually a gap down or a powerful intraday breakdown. I always take the risk to short as the triangle develops.

3) Initial Breakdown + Flag Combo:

The initial breakdown + flag combination is 2-part. Part I consists of a major breakdown (usually the largest red candle present in the entire uptrend) on massive above average volume (typically the largest volume present on the chart). Part II consists of a flag that indicates that the stock is in a reactionary rally and the volume must be low. The ideal time to short is not on the initial breakdown, but on the flag.

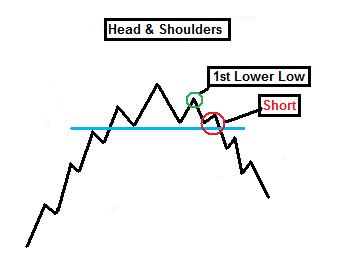

4) Head and Shoulders:

The H&S is a popular pattern. The most important part of the pattern is the right shoulder since a lower high is necessary to confirm that the uptrend is ending. Like the double top, you have the option to short on the breakdown or on any flag that develops on or near the neckline. Typically, there are several short entry points following the initial move lower.

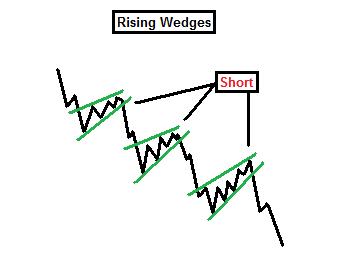

5) Rising Wedges:

Rising wedges would be difficult patterns to determine if it weren’t for volume. The wedge is a uptrending trading range that will become more and more narrow as it reaches the apex. Volume must get lighter and lighter as the pattern progresses. You may enter the wedge before a breakdown, but I like to short in the breakdown (which should be accompanied by volume expansion) for confirmation.

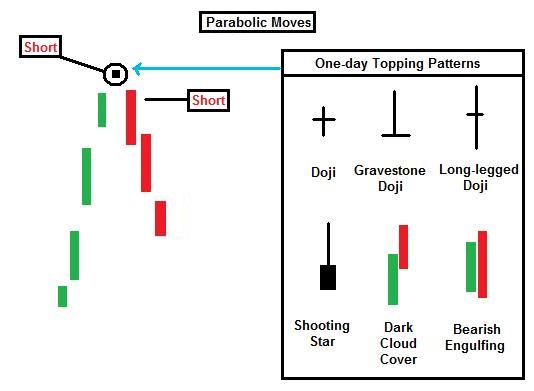

6) Parabolic Moves Up:

These are stocks that jump 100%, 200% or more in a span of several days. The top of the pattern is marked by buying exhaustion and the best way to determine the exact top is to look out for the following candlestick patterns: doji, gravestone doji, long-legged doji, shooting stars, dark could covers, and bearish engulfings. All patterns are typically accompanied by the highest volume bar on the entire chart. Entering on the topping day may provide more profit, but it is riskier. The next day is considered the confirmation day in which the stock breaks down. The 2nd option for entry (less risk) is to enter at the very beginning of the breakdown.

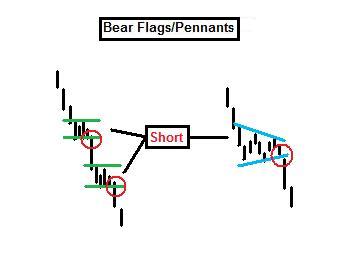

7) Bear Flags/Pennants:

Bear flags/pennants are the most common short patterns. They mark continuations in a downtrend and are highly reliable (similar to bull flags). The idea time is to obviously get in before the breakdown, and you may only have 1-2 days to do so. The volume must be light on the flag, and the volume should increase singificantly on the breakdown. Think of this pattern as an inverted flagpole /w flag.

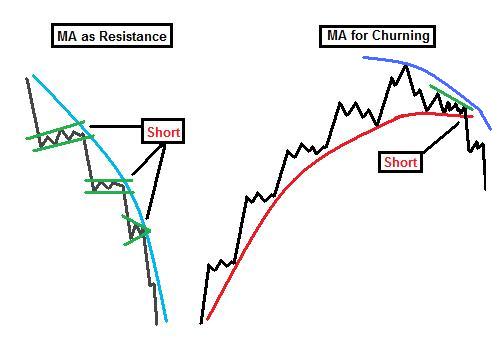

—Moving Averages—

In addition to the patterns themselves, moving averages play an important role. I use the 20-, 50-, 100-, and 200-day MA’s for long and short setups, but I also incorporate the 10- and 15-day MAs because a stock declines much faster, thus you will need a much shorter-term MA. Find the right MA that guides the stock because not all stocks follow the same MA.

I categorize moving averages in two ways: MA’s acting as resistance and MA’s for churning. Moving averages act as magnets and they are just as reliable as the setups they guide. When we went long, we used the various MA’s as support which acted as springboards to propel the stock higher. Think opposite of that now. MA’s for churning simple means that a stock flags either immediately above, on, or under a stock. Usually, the stock cannot make a higher higher and/or a 2nd MA is looking to catch up to the stock.

—Books—

Recommended books on short-selling:

1) How to Make Money Selling Stocks Short by William O’Neil (Wiley, 2005) – [Technical, Swing & Position Trading] 2) Sell & Sell Short by Dr. Alexander Elder (Wiley, 2008) – [Technical, Day Trading] 3) The Art of Short Selling by Kathryn Staley (Wiley, 1997) – [Fundamental] 4) Sold Short by Manuel Asensio (Wiley, 2001) – [Fundamental] 5) Sell Short: A Simpler, Safer Way to Profit When Stocks Go Down by Michael Shulman (Wiley 2009) – [Macro]

—

The best way to become an effective short seller is by making it a habit of studying hundreds and even thousands of charts every week. Train your eye to see the setups, the accompanying volume, how the MA’s line up, etc. The only way to do this is with practice. Short-selling can become very profitable due to the simple fact that stocks drop faster than they rise (in most cases) and for me, it typically only takes about 1-3 days to make a decent profit of 10% or more.

Trade only the best setups to increase your odds. I do recommend the use of stop losses above key resistance areas due to the fact that losing short positions can cause serious damage if left unattended.

—Short Setups—

Here are some POTENTIAL short setup that I found over the weekend:

If you enjoy the content at iBankCoin, please follow us on Twitter

As promised.

Have a great Father’s Day today!

do you think the market as a whole is shortable at these levels or are the ppt gang still looking for more upside?

C is for cookie! Awwwwn Nom nom nom!

Great. Thanks. I also like to look for stocks that are trading below their 200 dma personally. I also try to avoid stocks that have recently passed the “golden cross” point. Anyone care to comment on that approach? I like the looks of BAS and GMXR for shorts right now. I closed out GMXR three days ago and am looking for a reentry point, likewise BAS. Thoughts?

My watchlist for longs on monday:

CTIC seems to be at the bottom of a channel since the end of march (long since 1.4 before it took a dive)

DVAX at the bottom of upward trend since middle of april

NPSP target 5 (long since thursday 4.5)

PPHM (long since .82) not really sure about this one. will probably keep butting against 0.9 but a bigger drop could take it down to 0.7

AGEN if 2 holds then it could go to 2.5 and then 3

ANPI seems to be sitting at support at 1.84 and at the upward trendline from may.

and SUPG (hammy’s rec in the prior post)

disclaimer: i have no prior knowledge of TA prior to reading CA’s blog

BVF is upgraded and very close to breakout

HGSI

ALXA has triangles on 15, 30 and 60 min

this is great make your fans $

Thanks for another great lesson CA!

Thanks CA!

Hey Thanks CA for the tutorial.

I was wondering, which do you prefer?

200 Simple Moving Average or the 200 Exponential Moving Average?

Which is used more often?

What a great post! Did you ever do one of these for longs?

thanks CA – what do you think of BIDU as a short?

Hey CA what do you use to scan thousands of stocks a week? Thanks

Is there something in a subscription to Stockcharts?

great stuff, CA. thanks!

CA,

What about ASX, LJPC, LOCM, TER, DPZ? Are they suitable for shorting?

Thanks

CA, Do you have an article on Long Setups? Or are they just the inverted patterns of the ones you’ve presented in this article?

KidDisco – the general market is not ready. However, certain individual stocks are.

Pete – both. I use the SMA more.

Manaau – if you read the 2nd paragraph of this article, you would already know the answer to that question.

BIDU is a dangerous short. Not set up yet.

Musky – I use the MarketWatch scanner. I fill in only my desired price range and volume range. Stockcharts – no.

Flower – penny stocks? Are you out of your mind? I stick to stuff over $5, sometimes over $3. There is a larger margin of safety on larger priced stocks.

—

I understand that we attacked the cheapest shit on the long side, but you can’t be doing that on the short side.

Trader and Manaau – pay attention. Look in the “technical education” category.

http://ibankcoin.com/chart_addict/?cat=46

—

To avoid asking more ‘lazy questions’, look at the other educational categories:

Psychology Education: http://ibankcoin.com/chart_addict/?cat=14

Q&A’s with CA: http://ibankcoin.com/chart_addict/?cat=50

Great stuff.

I would add:

1. to your warning about a stop to make sure it is a market stop and not a limit stop – otherwise you can still get damaged with a gap above.

2. these same patterns work for daytrading

3. the inverse breakout (long) of these short patterns can be very powerful – creating a gap

4. another pattern to short is a channel top – odds improved with a descending channel – off the top of my mind DD and DOW (chemicals seem weak and in channels)

.. oh rounding tops too

thanks CA, what do you think about CHRS and RT as short candidates?

Their charts look more or less like the SAH chart in your list of potential shorts

CA,

Is that marketwatch the website or marketwatch in TOS?

Thanks

Thanks, John. Another post to print out, pin up & study.

Liking the Army of Doom artwork lately, too.

Inspirational.

Pete, did you read that Tim Wood article too?

Ca, you’re the shit man! Thanks.

wow.nice man.for starters its good article

cool, thx.

Don’t think CHRS and RT are quite ready.

Amstel – regular site. You can use any site/program, since the results of a scan should be the same for all.

Great stuff CA. Appreciate the work and help. Somewhat off topic, but as a bull flag set up, check out JDSU on the daily.

My long watchlist du jour: a few are a bit thinly traded.

ACFN ACLS ACTG ARMH ARTG ARTC AXTI BGCP CEUA CLWR CYDE ERHE FALC HBAN HIMX FLDR ICGE IFON MOVE NOVL SHFL SMOD SWWC WPTE ZHNE TPGI RDI HNSN HNBC PLAB OPK ZZ CBR CGA

Plan in 30mins is to remove SMN and FAZ at open. Individual stocks will be chosen to short if appropriate.

Juice – There are plenty of long setups, which suggests that the general market is not entirely ready to commit short.

CA – Curious what your thinking is on VVTV? Do you like the daily?

CA, that was my conclusion as well. Thanks for confirm.

CA – How was your Father’s Day weekend?

Good, thx.

VVTV is still in a flag formation. I would look to get long above $1.80.

CA – what do you think about DKS? i love that stock 😉

GILT – from last week – keeping one eye on it

Mornin’

One I’m looking at:

INCY above 3.27

Good luck all!

CA, is that an exhaustion gap on CCL? It’s from an existing downtrend, so not sure. I believe it has to form at the top for it to be valid?

Bought AVII $1.70

Waiting for 90.85ish on SPY to remove SMN/FAZ

VVTV looking good out of the gate, approaching that $1.80 BTFO area.

Sold FAZ $4.83

Sold SMN $20.21

Bought TSTR $1.88

Whoa – TSTR!

I’m not playing any cheap-o stocks in this market unless they have a story that will drive price independent of the market.

i.e. MEDX, GILT, TSTR all have compelling stories.

retox – did you get in medx – blasting today, I missed it, in fact my watch list sucks for the day, I’ll earn lunch money some other way.

SPY getting close to 200 day MA at 90.26

Sold TSTR $2.15

-quick +14% in 30 mins.

thanks CA!

another great post. you should consider to start an asset management company.

Buying CREE here

Dr. Sparks,

No – I want in on MEDX with some Jan 11 LEAPS (long dated options). I am willing to wait for the excitement to die out. Very similar to the way I want to play BA (Boeing) for a long term recovery (I covered that on post by DPeezy a couple of weeks ago – I was willing to wait there as well and, depending on the mkt, I might be close to my entry).

The part that attracted me to MEDX was this:

“aggressive forms tend to advance and spread quickly. By the time the cancer is diagnosed, treatment is usually ineffectual. These aggressive prostate cancers are the second-leading cause of cancer death (after lung cancer) in American men.”

Pardon my complete ignorance if I display it here but a drug like that – nobody would care about side effects if they are inoperable would they?

“So you say I might be impotent, hairy, and my vision might distort? Sounds better than dead to me doc!”

In other words, yes it takes tons of money but it would seem like anything that shows that kind of promise (if they can repeat these results) would be put on a faster track to approval?

Am I way off on that?

Nevermind about my MEDX info, retox posted a better version.

TSTR is right , I almost wish I hadnt sold out. Then again.. 60%+ gain aint bad. 🙂

Mike,

Yes, TSTR – I’m happy with mine as well. No regrets!

ES – another move down here? Then a bounce off of support…

retox – your spot on – these situations are often granted special status by the FDA, much more loosey goosey since there’s the alternative is zotz. The numbers of saves were tiny in the prelim report but that’s just what it is, prelim.

In ES for bounce

Sold AVII $1.62

CA, What you think of SIGA on the daily, w/ potential stop at the 50 MA

Out ES 900.50 +1.5

that was coco-nuts – alomst shook me out but I had a good feeling and a lucky-good entry.

Also watching ANPI on this pullback.

SIGA will prob bounce off the 50-day, even if it’s a weak one.

PTEN may bounce from the gap at 11.25??

200-day MA at 900 SPX

50-day MA at 898 SPX

—

Flower – probably a bounce off the 100-day at $11.40ish

ES buy 895.5

Sellin ES 896.5 +2

Sellin ES 896.5 +1 (correction from above)

MDTL like hell

buying TBT for a swing into these treasury sales

oh great…MDTL. SoaB!

Masterpain:

I think you might be a little early on the TBT trade. I love it for the longerterm. However, short term you might need to see TBT base around 51. That level should correspond with 95 on the TBT. Both TLT and TBT then will have done a 50% retracement of the most recent move over the past few months.

Just keep in mind, and scale into that trade. YOu’ll make a ton of money if you can hold tight.

THANX PISSANT BOUGHT HALF POSITION HERE. LOT OF TREASURIES THIS WEEK 104 BILLION

In short to MDTL at 97

Mike – 2nd that.

PS – anyone keeping tabs on AVNR? Broke out last Friday.

I am up a good +1.4% today and I don’t want to fuck it up, so no more day trades. I will add swing longs/shorts after 3PM. I’m still here though.

sold SMN @ $20.75.

Thanks CA.

$104 billion in treasuries to auction this week and a Fed meeting. If they announce more treasury purchases TBT could be painful.

ISTA – stopped out at 3.59/3.53/3.52 – was in from 2.85 avg. so still okay gain but I got all starry-eyed and greedy – should have taken profits at my original $4 target.

Back in BDK short – 28.10

Covered MDTL @ 83 (200 day at .81)

Look at RIMM…OUCH

ONTY just triggered an alert for me, looks like its crashing back but its worth watching imo

CA,

I think this might have been mentioned in a previous post, but I can’t find it anywhere for the life of me.

How do you determine the target price for a symmetrical triangle?

CA… What is your opinion on ESLR

In ONTY at 2.76

Todd, I usually take the widest part of the triangle (vertically) and add that on top of the breakout location. Seems to work most of the time

Mike,

Thanks. Just to be clear, I assume the break-out location is the top/bottom of the triangle?

ES headed down here again? Playing with less contracts for the rest of the day (2 instead of 4 or 5).

ES stop at BE 892.25

ES taking profits + 2 @ 890.25

Out a little early on the last ES trade but the bounces on days like today are pretty quick and I wanted to lock in the 4.5 points I’ve earned today.

2.5 points with 4 contracts (2 long trades) – $500

2 points with 2 contracts (1 short trade) – $200

ESLR – piece of shit

Mike is right. I drew it out: http://i587.photobucket.com/albums/ss311/chartaddict1/1-3.jpg

—

SMART move going into all cash last week.

ES short 892.50

Nice. iBC should put up permanent links up somewhere on this site to all your tutorials. I’m sure that would save a lot of time for people and you won’t have to answer so many of the same questions. It’s good stuff.

AND…21 out of the 24 charts above broke the fuck down.

My article was 1-day late. But, this shit is just getting started. I’ll catch the secondary entry points.

It will be an easy +15% gain.

That was fun.

ES covered at 892.5 BE

watching TSTR for a break (1 min).

sorry – no, I’m not, my charts are goofy today (2nd day in a row).

CA thanks…took your advice on ACAS and sold all over

4.20 as you recommended

covered BDK short from 28.10 at 27.91

+.19

CA to me the best chart above was TIE I took a little of that this morning

tried to short TSM this morning but broker gave message “this security is not available to sell short for today.” don’t know what the fuck that’s about. i like the dakt chart a lot too, but am just watching now.

Following the Horus Heresy, we are now in the Age of Rebirth.

CA,

I’m feeling a run back toward 900 coming. You?

Close above 200-day would be perfect. It will provide short setups for tomorrow.

Might enter NPSP again. Its holding up relatively well and a break above 4.60 might bring some new money in…

So sick of people that say “buy on dips”. Fuck you, call a price.

Waste of time otherwise and you shouldn’t be on TV.

“Oh, uh, I think you should sell the tops and uh, Maria, I uh, am really glad I paid you to have me on TV today.”

Bought NPSP @ 4.53

CA-

I took a peek at things (couldn’t resist), and you may be right on the short setup.

The S&P has now corrected back to the 200 dma which could provide a bounce point. But the bounce is more likely instead, at the sector level for consumer discretionary, industrials, materials and energy, which have pulled back to, or below the May lows.

However, given that most intermediate term indicators are overbought and early in their downturn, people shouldn’t be buying aggressively today, for Costanza’s sake.

Sector rotation is rabid and rapid. Watch the Euro/Yen cross. A meltdown below 133 and the global equity markets will go south along with it.

Good stuff. You got it going, CA.

exactly right, retox. make calls real time or get lost. Not the ones like “in SIRI .3611” “out SIRI .3612” for one micro cent profit.

Hey ALPHA short UEC?

Alpha,

For a while I thought that Italian bond caper was you moving your winnings around – happened the day you left – coincidence?

sg, TOO TRUE! but at least the people doing that are willing to put a number down.

CA,

Thoughts on FAZ and TZA? Get Back IN?

LR

Hey Alpha! What’s new?

There goes ONTY, another 10%+ pick to close out a profitable day

Any of you guys expecting a dead cat bounce tomorrow?

I’m not going to use iETFs. I will be shorting individual names.

What about turn around Tuesday….non-believers

FAZ just won’t stop. I keep trailing 10cents. CA, what do u think @ overnight? I am in since 4.72.

Existing home sales @ 10:00 AM.

Could be a market mover.

Always has been the last few months.

KBH,PHM,RYL up.

Bay Area…FAZ is a demon…I’d take half off. It could go back down to below 5 overnight.

Just watching all the fun and games in the market recently

Typical summer action, back and forth, rangebound. Good luck trading.

The bigger picture is shaping up for the worse, though. More on this at a later time.

The trout are calling me.

Fudge. Not enough time. Overnight it is, unless, maybe AH. Lovely for now, nevertheless.

masterpain

Can you even borrow shares? Lots of other stuff to short here.

Buying a little ES 887.75 for an overnight retrace. target 892

100% cash. Will wait one more day for the ‘perfect’ setup.

+1.4%.

All cash Friday and again today. Not in the mood for an overnight bet on tomorrow’s open.

Greg

Breath better now. Took half off FAZ AH at 4.44. Later all!

Thanks for the great educational posts CA!

Homework for tonight: find those short setups.

Some action on GTXI starting around 1:15 … no news, did that doji (15 min chart) signal a reversal?

Actually, my article came just in time on Sunday.

—

GXTI – yes, and formed a hammer on the daily on high volume. Upside potential present.

CA – what’s your take on the S&P 50/200 day moving average cross, which is typically considered positive, with the closing below these?

ES trades for today:

http://s699.photobucket.com/albums/vv352/retox13/?action=view¤t=esjune22.jpg&newest=1

887.75 long entry @ close is still open / + 1 now with a PT @ 892 and no stop

short screen june 23rd after close:

BKCC

BTE

DRH

IWA

KRG

SR

VNO

WYN

LHO

O

this is a fundamentals be shitty screen, and the charts all look good. but everything looks like a short right now.

many of these are REITs. I think the REITs may finally get hit this time.

p/fcf > 50

debt/equity > 0.5

float short < 10%

EPS next year < 0

I did two individual shorts today: MDP and TPX. I already had TWM and DUG going, then was looking for targets (let’s not talk about my long portfolio). these two were previously screened, but not checked for a few days. both of them were up a bit and I expected them to join the death spiral. a mistake, they both survived my ill-will and I took them out for minimal losses. perhaps I would’ve got a day trade out of them but they weren’t acting right. actually TPX did eventually drop, so I was impatient. looking at them now I see that both had a nice high volume pop on friday.

seek yee the weak of the herd and prey yee upon them and only them.

This is one of the best articles I have read on Shorting patterns. Thank you.

Can someone tell me how to find the previous article on long patterns?

Thanks

You must be new, so I’ll give you a break.

http://ibankcoin.com/chart_addict/?p=818

Yes I am brand new..the twitter folks pointed me your way. Thanks for the help

The Chart “Rainmaker” Addict!

Bringing ALL the new blood to iBC!

Make it easy for CA to scan your picks.

Go to http://www.finviz.com and enter all your suggested tickers

hit filter

make sure all your charts show up

copy the address and paste into your post as below –

badass site to do quick screens and find patterns!

http://finviz.com/screener.ashx?v=210&t=WES,ATMI,CHBT,CA,UFCS,LEN

sorry if that last one came across as too pushy – just get excited sometimes… mom says I’m still a young dumbass.

Another vote for finviz – it’s been very good for me, especially using the Overview / Chart mode to look at a lot of charts quickly.

Short ANR great ranger

CA,

What will you be looking for tomorrow before entering shorts? will you be shorting the shit that was down hard today like commodities on any strength?

What do you think of AFL & EL (Daily)as short candidates?

thanks

WTI seems looks good to short

TV, SWC, SSRI

Flower, Gonzo, and others: Guys i’m amazed, you are just now looking for short setups. The stocks are already down 20 and 30 percent or more in some cases. It’s a little late, risk/reward is not in your favor anymore.

Beware, or you’ll get your face ripped off. As CA has said, wait for a bounce. In my opinion it’ll be a multiday bounce that will lead to a head and shoulders pattern in the SPX.

CAB & WFMI Daily look good to short

Daily

Great stuff, CA, appreciated as always. Still hoping that IBC creates a “printable version” option so that posts like this can be printed (as a “clean” version) and saved for future reference.

P.S. I think on the “descending triangle,” you meant “lower highs,” not “lower lows”. . . ?

fixed. thx

FXI looks to be a good short candidate based on your patterns above