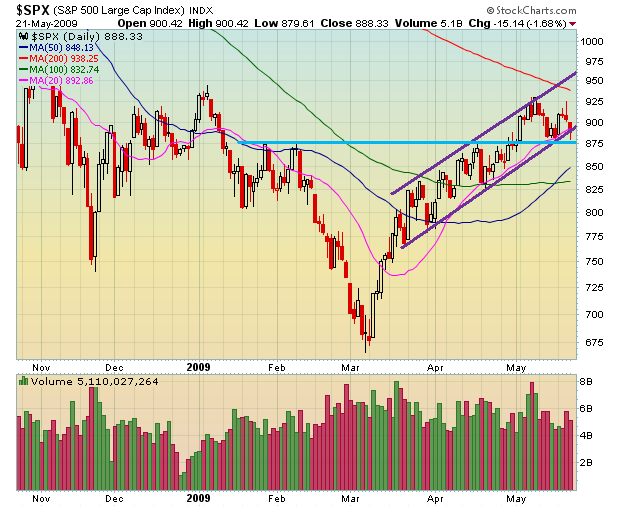

The market hit the 880 level, which was the final support level in my book yesterday. The end of the day, which was met with some serious buying (and not just short covering), was encouraging. Today’s action plan is simple, and it is all drawn out on the 3-day chart below. I added a “blank day” so you can use it intra-day to see where the market is located. I do this everyday, and it is a method that I highly recommend.

The red box is “today”. The green zone is your support level and the purple zone is your resistance level. The two blue lines in between are minor support and/or resistance levels. That’s it. Don’t make it any more complicated than this.

We are still in a multi-week consolidation, so you better be hedged. Play both sides of the market, or else you will suffer tremendously. I was down only -2% yesterday, even though I was (and still am) 65% long and 10% short. I will be doing some rebalancing, buying and selling stuff, ahead of the Memorial Day weekend. Don’t forget that the markets are closed on Monday, so…you might want to plan ahead for it.

woo hoo – first to post. Good stuff as usual CA – SPX 800 here we come

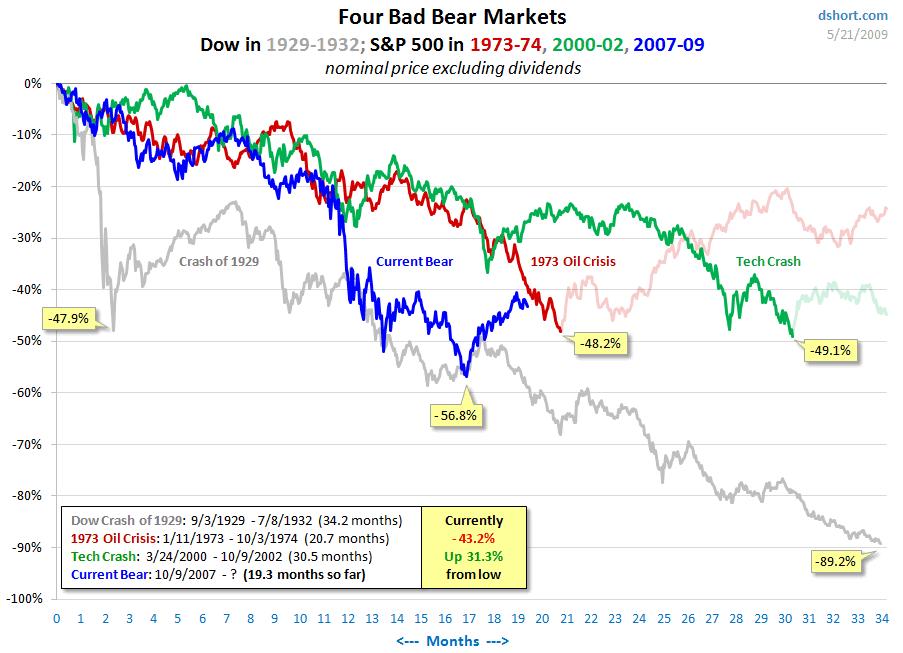

I think after a technical bounce, the markets next move is down. I will be using the bounce to load up on an assortment of diETF’s.

Juice- when do you anticipate the move down? Depending on how today goes, we may complete an inverse H&S on the SPX hourly. Do you think we will still head down if that’s the case? Appreciate your thoughts on this.

Sargent FAZ and Major QID commencing operation TakeDown will approach the dropzone at 1670 deep into Nas territory…

Got your boots on?

it seems the market wants to go higher

hey CA,

thanks for the chart! hope you win big!

thx

Hey CA –

Does the S&P look like a double top for you? Would it be a fair trade to buy SRS and use the 18 day S&P as resistance?

You really do a great job of laying it all out. Maybe you could recommend some of your favorite books sometime.

Thanks,

John

fwiw, best guess; today ‘should’ be up into the weekend … follow through tuesday & selling resumes by wednesday latest.

thats my gameplan…. subject to revision, naturally.

regarding CTIC, technically looks great .. but from what I’ve read, it will eventually go back to penny status, so play it to take quick profits, as many of these garbagio plays, because you never know when you’ll be BKUNA’d.

GRO

Juice and CA, what is the timeline on CTIC? I don’t have a stop on this guy and I’m not sure where the low threshold channel is – $1?

B’Kuna Matata, my friends! (the kids actually sang that in a school performance yesterday — fitting).

_______

I defer to CA on CTIC technicals, however imo, it should make its move very very soon, by early next week, or I’d take it off my sheets. Although it does look great right now.

fwiw, the fundamental case from Adam Feuerstein –

My coverage of Cell Therapeutics(CTIC Quote) continues to draw interest, including this email from Phil R.:

“Can you explain the disparity in your evaluation of potential income for Allos Therapeutics(ALTH Quote) and Cell Therapeutics? I understand Allos’ drug candidate for peripheral T-cell lymphoma is approximately 10% of the overall non-Hodgkin’s lymphoma (NHL) disease market. If you criticize Cell Therapeutics’ market potential for NHL how can you then pass on Allos’, which is a smaller market?”

Great question, but let me rephrase to make it a bit clearer. What Phil wants to know is how I can be bullish on Allos and its lymphoma drug pralatrexate and bearish on Cell Therapeutics and its drug pixantrone, even though pralatrexate addresses a smaller patient population than pixantrone.

Allos’ pralatrexate addresses a small population of about 5,000 patients with peripheral T-cell lymphoma (PTCL) in the U.S., but the drug would be the first approved to treat the disease. Today, PTCL patients are generally treated with a hodgepodge of chemotherapy regimens, none of which work very well.

I’d put pralatrexate peak sales in the U.S. between $200 million and $400 million (assuming premium pricing), with upside coming from expanded use in other cancers, including lung, if such use is justified by clinical data.

Cell Therapeutics’ pixantrone belongs to a class of cancer medicines (anthracylines) that includes generic competition. As I discussed last week, pixantrone will be used to treat a few thousand lymphoma patients who have exhausted all their other medical options.

Cell Therapeutics contends that pixantrone causes less heart toxicity than other anthracyclines and will therefore benefit from more widespread use. I believe the data on pixantrone suggests otherwise. At the very least, I believe doctors will look at pixantrone as only marginally better than other anthracylcines but will have very little incentive to make a switch.

Sales of pixantrone, therefore, will be hard pressed to surpass $100 million, if the drug is even approved.

The valuations of both Allos and Cell Therapeutics are starkly different, too. Allos’ enterprise value is less than $500 million, while Cell Therapeutics is $800 million-plus.

So, count me bullish on Allos and bearish on Cell Therapeutics.

Bought UXG $2.17

Right, the technicals say that I should hold CTIC for just a few more days or else GTFO.

Thank you both very much!

Forget the fundies or the science on CTIC:

http://www.thestreet.com/story/10501071/1/biotech-stock-mailbag-cell-therapeutics.html

Bought UXG at $2.19. Go baby go!

No one else feeling GRO?

Hemispherx Biopharma (HEB): Ampligen (Poly I: Poly C12U) NDA (three month PDUFA decision date delay was announced on 2/18/09 as additional data was submitted by HEB within three months of original decision date). Ampligen is an experimental treatment for chronic fatigue syndrome (which has no FDA-approved treatments) and the drug has an Orphan Drug Status with a PDUFA decision date of 5/25/09.

Big volume yesterday …. but, they just did $16M offering before the PDUFA date …. sounds like a short.

Bought END $1.38

got END @1.39

a boring day.

Bought DVAX $1.17

A word on thinly traded stocks, you will have to accumulate for several minutes or set automatic buy orders. Don’t buy like 20,000 shares or shit all at once, esp if they’re market orders.

Sold LEA $1.56 – follows general market too closely.

CA, is that a symmetrical triangle forming on the daily chart of DVAX?

CA,

How’s my (i bank)COIN looking? I think it’s about to make a good move up.

Yes Jam, its a sym tri

Leech – yup, and SEED, FEED, etc.

CA – I’m long CTIC from 1.29, you think if CTIC is gonna make a move it will be next week and if nothing, get out?

added more to END…perfect setup……for 30% END….70% cash

Make or break for CTIC next week? If no moves, getting out?

just bought some KV/A, looks like seller is just about to be getting done @ 1.62

Have a great holiday weekend everyone!

what do you think about PALM??

I bought some this AM @ 9.98…with the 50MA just below @ 9.75…and the release date of the new phone 14 days from today..could run into release..

Bought THLD $1.82

PALM must hold the 50-day MA

CA – what’s up with coal? I’m in NCOC and went to pee when it ran up to $2, now I’m just watching it sink. I’ve got a stop on at 1.53, but i’m not happy about it hitting…

markets gonna be going down later today or early next week. key is to find 1-3$ stocks which are not really affected by market direction and CA is DA MAN to find them..

Despite the illustrious Sir Flea & Dr. Kass, I think the next big move will be lower, aside from next Tuesday probably being up. I’m looking for sub SPX 850.

Although, its tough to go against those 2.

CA – when did you enter OXGN ?

Franky – NCOC is consolidating, might be a bit.

TT – $2.05. Exit $2.57. I don’t list daytrades, or else I will fuck myself up.

All positions in the comments are swings.

cool.

Im in END, DVAX and THLD with ya…

thx dude !

Closed out GRO at 2.65. Bought at 2.08 this morning. Have a good weekend fellas — especially you CA!

Anyone else see a top half of the batman symbol for today’s chart?

Bought additional 2.5% FAZ $5.56 due to increased long exposure

Have a good memorial weekend CA, thanks for your inputs this week.

EVERYONE HAVE A GOOD ONE.

take a look at BJS 24/25 options.

Not much action on CTIC – you think if it doesn’t make a move next week, could be time to bail?

very bearish move today. I added my partial removal of /es and put it in Puts. watch this gap down and move on down

Pati – and..

CTIC is consolidating

Josh, you’ve been calling gaps to the downside for weeks. Do you ever leave the possibility of a gap up once in a while?

actually was thinking gap up today. i call gaps a lot. but this will be the one. I am like 65%+ for gap calls. But i get the major ones. unless markets gap up big we go down

sell the bounce forget buy the dip

I missed answered some people’s questions here during the day:

Shree (9:51AM) – double top is possible. So is a descending triangle, or a pennant, or…etc. It is too early to tell which is why I have exposure to both sides of the market.

JCII100 (9:52AM) – what kind of books and what level? I have an old Amazon list which I haven’t updated in a while, but I own all of these books: http://astore.amazon.com/wtc0c1-20.

All CTIC inquiries – A move next week is expected.

Josh – I’m not sure why you are calling gaps because they (and the catalysts that create them) are first, entirely unknown until the futures trade, and second, are completely out of your control. I suggest that you stop doing it since there is no point in doing so.

Looking out 4-6 weeks, I think the market will considerably lower (10-15%) from where we are now.

The markets might bounce back some next week, good chance to load up.

Will the US really lose the AAA status? I doubt it.