BTFO!

If you’ve been following me for the past 6 weeks, you know that I have called breakouts almost immediately before they do so. I was asked by dozens and dozens of people to provide some sort of educational post on what I lookout for. The primary patterns that make it on my imminent, potential, and waiting lists are as follows: 1) parabolic breakout+symmetrical triangle, 2) bull flag, 3) ascending triangle, 4) failed descending triangle, 5) rounded bottom, 6) flat base, 7) measured move.

Each pattern must utilize price action, volume, moving averages (15, 20, 50, 100, 200-day), and the development of the pattern itself. The entry point is marked when everything “lines up perfectly”.

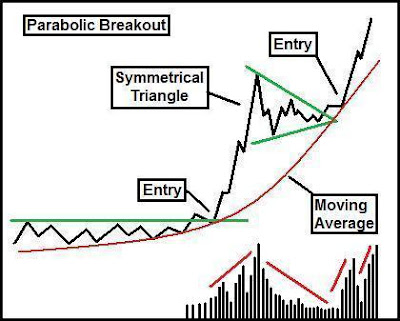

1) Parabolic Breakout and Symmetrical Triangle:

These patterns are the intra-day spikes that I covet dearly. They are responsible for many of the fastest and largest gains that I have ever achieved. This pattern utilizes 2 or more continuation or consolidation patterns to complete itself. They are usually flat bases, flags, and a variety of triangles. When the pattern goes parabolic intra-day, there will usually be massive profit taking and the entire move could retrace as much as 50%. Most weakhands would sell in panic when this occurs. However, this is wrong.

After a large move, the pattern needs to consolidate it’s gains, shake out the weak holders, attract the dip buyers, and gather accumulation and interest for the next run up. Towards the end of the consolidating period, there will be another breakout, which marks a secondary entry to add another position.

Volume must be flat and declining prior to the spike, which will be accompanied by huge volume. In addition, the moving averages listed above will help guide you to time your entry. My favorite short-term averages are the 15- and 20-day MA’s. 50- and 100-day MA’s are intermediate averages, and the 200-day MA is the big daddy himself – the most important long-term MA.

Whenever you see a symmetrical triangle form after the initial spike, it is almost a guarantee that the particular stock will breakout again. Failures are rare, but they do happen.The point is to harvest as many of these patterns and cut losses on any of the failures.

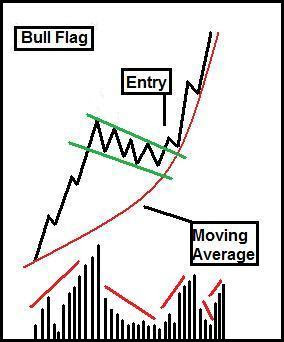

2) Bull Flag:

Bull flags are usually very small and can last for only one day or several weeks. The way to tell the entry is by using the appropriate moving averages. Sometimes, I like to enter a flag regardless for fear that I may miss the breakout. However, the closer the pattern is to the 15- or 20-day, the faster the breakout will materialize.

3) Ascending Triangle:

The ascending triangle is one of the most obvious bullish patterns, and one that is highly reliable. Each trough is marked by selling exhaustion while the buyers hold their ground. You want to either get in on the breakout from the pattern or if you are more tolerant to risk, then enter within the pattern and just sit tight. Do not get shaken out.

4) Failed Descending Triangle:

Sometimes, when a pattern fails, it can be a good thing. A pattern failure will force holders on one side of a trade to immediately reconsider. A descending triangle is a bearish pattern but occasionally, it will fail. This will force short covering and a great time to add longs at the same time. I like to get in on the breakout on confirmation.

5) Rounded Bottom:

This pattern takes months, even years, to develop. The pattern is created by a downtrend, followed by a sideways neutral range. When the right side of this “saucer” develops, it will be obvious that the stock/market wants to go up. There should be a massive increase in volume on the breakouts following the final completing of the right side of the pattern. Shorts will cover their positions as they realize that they can no longer profit from the stock.

When the multi-month base is forming, the main moving averages should catch up to the stock. They should level off and start heading higher and support the stock as a “launching pad” for continuous breakouts.

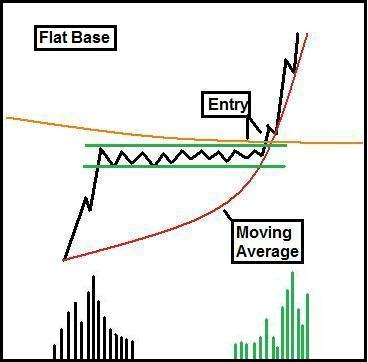

6) Flat Base:

A flat base is basically an over extended flag trading in a neutral range on low volume. These patterns have one of the most powerful breakouts, ever. A stock can easily double in a matter of days/weeks. There should be no evidence of breakdown in this pattern and they should be entered immediately when you first find them. When the breakout occurs, it its highly likely that you never see pre-breakout prices for a long time.

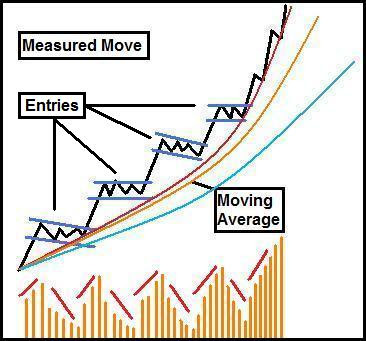

7) Measured Move:

The measured move pattern is one of the most beautiful and predictable patterns. They easily launch from their supporting moving average. The best part is that several moving averages should provide support below the stock. They act as back up in case there is a failure.There should be decreasing volume during consolidation, followed by large volume breakouts.

I hope this helps.

If you enjoy the content at iBankCoin, please follow us on Twitter

great post, for chart chompers of course.

This post is MONEY.

that picture makes me nostalgic.

ZERG RUSH!!!!! KEKEKEKE

I KNOW THIS GUY~~!!!!!

Thanks CA, definitely saving this. I might add, it is a beautiful thing when one of those patterns takes part in a larger cup & handle pattern.

Do u play starcraft? I was a WG Tour progamer in starcraft when I was 14 lol.

The C&P pattern is basically a rounded bottom followed by a bull flag.

Nice

I left SC bnet when 90% of the games were played on BGH. Infinite resources are no fun.

Oh, Starcraft. Brings back memories of getting my ass handed to me by a bunch of nerds on Battle.net.

One of my most vivid memories is of my expensively assembled Dragoon squadron getting annihilated in a field of spider mines. Oh, the horror! It was unspeakable!

That said, I’m looking forward to SC2.

Great stuff CA,

Especially watching your calls real time and having them BTFO. Incredible.

I hope you don’t let the haters on here kill your game. You and RC were on fire on the PPT last week, keep it up, you rock!

Nice work! You and Rage have been on a killing spree!

CA: hahaha heck yeah, i played a ton of starcraft, interesting to see a ton of people here did as well, i was worried my joke would be lost

I left SC bnet when 90% of the games were played on BGH. Infinite resources are no fun.

charlie: ohmygosh, i probably haven’t played starcraft in a long long time, but i immediately recognized “big game hunter”. wow, i probably haven’t thought of that phrase in over six years. christ.

i’m up a couple SC2 games or something when it comes out.

Very clear. Noice job, indude.

I’ll challenge anyone here in a game of SC.

Love the flat base!!!!

Awesome post, very educational. Thanks.

Thanks for the post, great stuff. Are you using pattern recognition software to find these setups? ie. stockfetchter?

Thank you for your time and work on this. Your a pro.

Thank you!!!

Beautiful summary. Edwards and McGee couldn’t have said it any better.

Love those breakout patterns. This will help immensely. Thanks for all your work!!

Hey CA,

You should go to Korea…believe or not, those guys over there still play Starcraft 24/7.

I went there about 6 months ago and they had A WHOLE CHANNEL dedicated just on Starcraft plays.

It’s pretty big out there…

PS. When does Starcraft II comes out? I’ve been waiting for YEARS since they last announce it was coming shortly.

Hey chart thank you for posting this great article. Thanks for all your work and all you do to help the community.

This post is exactly what I’ve been waiting for, thank you! CA, I have already learned so much from you and I very much appreciate your blog.

Thank you very much. Found your place a couple of months ago. So sorry I did not find you earlier.

Good post…much appreciated.

By the way, Dad had a 14′ Starcraft with a 10hp Johnson when I was a kid (late40’s, 50’s). Caught lotsa fish in that thing.

Speaking of infinite resources…

Thanks for the post CA, exactly what I was hoping for. Off to find some goodies of my own!

Bought DVAX $1.199

Bought NNBR $1.64

Bought ICAD $1.27

Sold TVL, $2.98, +71% gain

TVL was great. Just sold CNO for a 92% gain.

bought EMKR $1.359

i know you sold this, but emkr looks to be forming nice flat base towards its 20 dma (still a handful of days for it to touch its 20 dma)

also, cnxt is consolidating and is sitting right on its 20 dma

CA – are you still holding HGSI or ARM?

Just a quick poll:

CA, I’m pretty sure you use stockcharts.com for your research but what about the rest of you guys? I’m currently using ScottradeELITE but it displays MA’s in periods instead of days which makes this sort of miniute by minute analysis difficult at best. Any other suggestions?

goon – bought 3 mins before u posted ur comment!

HGSI only franky

BBI @ 1.17 nice flag…..

PPT just upgraded ARTC to strong buy, thoughts? Not sure chart is looking like a breakaway though

APL in @ 5.25

Bought PLLL $2.07

MEG looks to be finally BTFO ….

in PLLL at 2.14

PED?

What a great post! Thank you for your work.

ALTI @ 1.38 another nice flag

Failed Descending Triangle + Flat Base = Story of my Gains.

Kick ass post!

Bought AHD $3.04

keep buying..good..got abk today

Thank you for the great post CA, very informative.

What do you think is the best way to track down these breakout players? Sort a list of low volume sub $5 securities or stick to a certain sector?

SFI..nice break out with good volume…got it

Bought XTEX $3.75

wow

AHD rocking btw bot XTEX

Thank you very much for taking the time to post this. Everyone should know about these things. I enjoy learning new things so I subscribe to blogs like yours. Frances

CA and this thread rocks!

Anyone else with Fly on RFMD?

Excellent post. Printing to pdf and adding to my library.

Uh, make that copy/paste to OpenOffice Writer THEN print to pdf.

What’s the deal with preventing posts to be printed?

Vincenzo!

Hey CA,

What do you think about CNB? Up nice today but I think it’s just getting started.

LR

Thanx CA

This is the type of post that makes weeding through all the obsequious/obstreperous BS worthwhile.

brushbuck…..

I am too old to know anything about SC game but I do have a 30yr old 14′ Starcraft with a 25 Evinrude that I still use in Lake Okeechobee to get way back in the thick shit without messing up my good boat. Pong anyone?

CNB possibly a continuous gapper upper, but I won’t chase it myself.

WH humbly submitted. In a tad.

Help! My stock is rising and I can’t get up!

No, seriously, my CORS is breaking out much higher than I expected. Is it beyond what the charts would say?

WH – not yet

That Feb breakaway gap down should display resistance on CORS

Great post Addict – one of the all time best in my book.

when you enter a position on these patterns, what do you use as your stops?

thx heckler

Keith, I do not use stops.

CA,

what do you think about ALTI over 1.50…big volume

Oh, I think I forgot to mention. BEST. POST. EVER.

buying ARNA here at 3.01

SONS looking ready to rip above $2…finally.

CA,

I kind of like the look of BEE

Watcha think? It hasn’t run yet, but will it?

LR

Flyguy – good

thx frog

SONS 200-day MA is at $2.05

BEE’s been on my list. I’m just waiting.

i think SONS makes it through the 200 day…it’s been consolidating between $1.50 and $2.00 forever…

I would give it a shot, but chart is too messy for me.

Bought BEE $1.33

CA,

Thanks for BZ and this post.

TT

I love the PPT!!!

CORS anyone?

Shorts dying a slow death ovah heah … MEG!

Short % of Float (as of 09-Apr-09): 24.80%

Thanks for the great chart and info….

you’re welcome all.

I just want to say thanks. I usually don´t write much, but I think you are an incredible human being helping me and others with your kind knowledge, to make some coin. God Bless.

En Taro CA!

Another impressive day, well done.

fuck; didnt know emkr was reporting after the close

CA–EMKR is beaten post-earnings…..u still holdin it??

good post

Thanks! I really appreciate this. I’ll be spending some time with this post.

This post is

…beautiful. :’ )

Now just a post on position sizing and money management. I assume you just put on the whole intended size from the start and let it work its way out? It’d be interesting to know.

CA, as others, I also want to take the time to thank you very much for your alerts today. (I also printed out your post to study.) I happened to catch your alert for AHD and I made $150 in about 20 minutes or so. (I work full time but at times at work I am able to scan blogs and trade but my time is limited.) I have a wonderful wife and three kids and this extra money really helps with our car payment and future expenses like Christmas or a vacation. There’s always some bill or expense lurking around the corner so the extra money really helps allot. Again, you are very kind to take the time to post those alerts. I truly appreciate it. You are a first class act!!!

Fig looks good for a flag/cup and handle….. i just dont think i will be playing it

and that is because there was no bull trend prior to formation of cup and handle

EMKR – I am aware of the loss, unfortunate. In this case, it is important to watch the 20-day MA, located around $1.15.

As for position sizing, all longs are around 5% each, less than my standard 10%. Even if one of those picks melt down 20%, it’s only a 1% loss, which is nothing. These dollar stocks are crazy.

Seems like a whole bunch of people made money today, on a -2% down day on the SPX. One of the biggest characteristics of these dollar stocks is that they are amazingly resilient to overall market conditions. They move however they wish, regardless of market direction.

Josh – the ‘prior bull trend’ on FIG is when it went from $1 to $8 in a matter of 2 months. I would call that a bull trend.

Fig is in a bull trend and consolidating, I think the price I would pull the long trigger is above $6.8

however, a cup and handle if i remember correctly needs to run up and the form left side of cup, then bottom only to go up again and form handle. Fig just went down and then formed a strong base. A base I expect to be broken or retested at some point, but that is off in the distance

Sometimes, you gotta forget textbook rules and improvise. Right now, a lot stocks defy ‘normal’ technical analysis.

This was TOO valuable to be wasted in ibc.

Belongs as a Permanent Post in PPT.

lol

Hope it helps you forever.