Some of you supposed eight figure account stock mavens love spouting out the phrase, “the bond traders are the smartest people in the room”, or “credit leads equity.” This is all true, and I am not here to argue with that.

What I am here to do, for the more novice and honest market participants, is to explain what exactly credit spreads are, how to interpret them, their current condition, and what they may tell us about future market moves.

I’m not calling bull or bear; I’m simply providing you with an unemotional approach that should only be a minor part of you complete macro and micro analysis.

First, what is a credit spread? Many of you will hit up Investopedia, which says “The spread between Treasury securities and non-Treasury securities that are identical in all respects except for quality rating.” Then you’ll Google Treasury security, and then quality rating.

Here’s what to know. Treasury securities are theoretically and as close as you can get to a risk-free investment, and it’s a safe haven for a risk-off environment. Thus, for you religious enthusiasts, the reason Fly has been calling TLT (20 year+ Treasuries) the Ark.

A non-Treasury security could be a corporate bond, which is a little riskier, and a junk/high yield bond which is even riskier than the other two. Quality rating is simply an [allegedly] independent rating of the level of risk found in the security.

When comparing spreads, both securities have the same maturity, meaning the time period when the principal amount of the bond is due. A bond is simply a loan with interest. Hence, Bail BONDSm an for you vagrants. They have a high interest rate here because there’s a high risk with the criminal. Make sense?

Next, how should one interpret the spreads? As a side note, never analyze or try to paint a picture in a vacuum. Look at the trends, and try to make a story of it. Moving on, remember this: The higher the rating, the lower the return, but the safer the asset is, i.e., less likely to default.

In turn, widening, or increasing, spreads suggest there is growing anxiety about the ability of a riskier borrower to pay off their interest and principal payments, while narrowing, or decreasing, spreads indicate a confidence in that the borrower won’t be a free-loader and default.

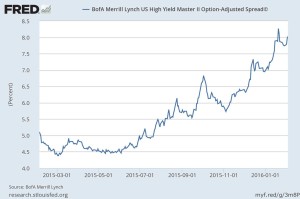

Which brings us to today, and what two important credit spreads are showing us. The first compares investment grade corporate bonds vs. Treasuries, and the second is high yield corporate bonds (which are riskier than investment grade) vs. Treasuries.

You’ll notice that these generally follow a similar pattern. However, when one diverges from the other, this can produce actionable objective signals to implore. For example, I wrote a post in early-mid November saying that the high yield spread was diverging (showing a different pattern) than the investment grade spread. Two to three weeks later, all the rage was high yield collapsing.

What has recently caught my attention is the divergence on January 22 of the high yield spread and investment grade spread. Where the high yield spread actually fell and has slowly began to creep up, the investment grade spread has been consistently increasing.

This could signal a few things, but what I’m taking from this is that credit fears are not merely contained in these highly levered oil and material companies found in the junk bond bin. It appears that the qualms and worries have trickled into investment grade credit.

My personal take is this divergence should be factored in when determining how much risk is currently in the market. While I’m still long a handful of equities, my cash level is around 45% and has been like this for a couple months. I will continue to tread lightly, and this confirms my current stance.

Finally, I ran a quick comparison of the one year return of CROP (investment grade corporate bond ETF) and HYG (high yield corporate bond ETF). HYG is down around 13.5% while CORP has only been down 6%. In turn, CORP seems to have some room to drop. The actionable trade out of this is to consider buying puts (or bet against) on CORP; I will be initiating this move in the next day or so.

If you enjoy the content at iBankCoin, please follow us on Twitter

Note, I plan on using LQD instead of CORP to buy puts. Did not realize how much more volume LQD trades at. Same concepts apply; LQD is a corporate investment grade ETF that hasn’t had a pronounced drop yet.

good post nigga

Also note Lending Club put out a notice that they are seeing default rates climb too on the loans on their platform. And the fed still wants to increase rates….

@Boyaj – Great post man. FX leads everything though & bond traders are usually the smartest 🙂

Follow me back @Probucks_ & check out my blog plz. (link on twitter & won’t post out of respect for IBC)

Love the educational breakdowns.