Last Wednesday Janet Yellen came up to the podium to discuss the suddenly dovish Fed’s 180 degree turn in policy from raising rates 4 times this year to now only 2 and recognizing the global stresses on the system. The Fed has been telling the world that they are data dependent but clearly they are not. Instead they are credit market and S&P dependent. Anyone with a brain knows that but alas you would be surprised at the number of folks who still think the Fed knows what it is doing.

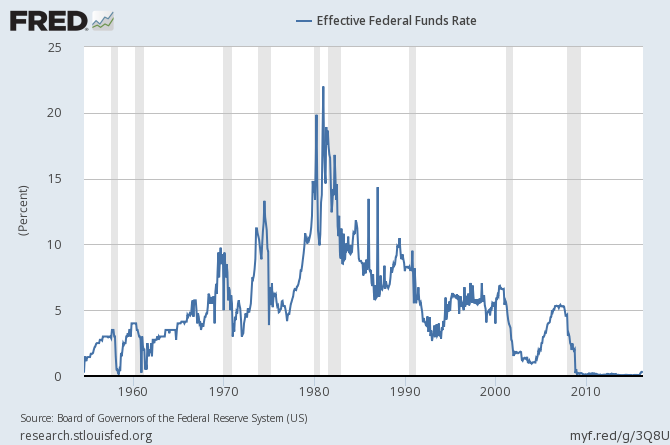

Essentially the Fed just told the world that things might not be so good after all. Both Greenspan and Bernanke had to pull 180’s after the business cycle rolled and began to cut interest rates in late 2000 and late 2007 respectively (Chart Below). What many forget to realize is that both credit and the S&P continued to collapse even as they were both aggressively easing. I would contend that Janet is extremely behind the eight ball on the burgeoning business cycle decline and is in fact months behind her predecessors in beginning an easing cycle because she never raised rates much at all.

History actually suggests that once the Fed recognizes the problem and acts, like Janet so timidly just did, is not bullish at all but in fact it is quite bearish. The easing cycle actually kicks off the real meat of the damage in the bear market that is not yet fully recognized by the majority of market participants. Additionally, time has a role in this drama because charts are both price and time. It seems, absent crashes, once a top is put in the bulls and bears battle for control until the 9-10 month mark where the bears finally gain full control and the investing public wakes up to some nasty losses. In the October 2007 top 9 months was July/August of 2008 and we all know what happened after that summer. In the March 2000 top 9-10 months later was January 2001 when the bear market really started to accelerate. This time analogue has also worked in other secular bear markets as well. In 1973 the market peaked in January and then 9 months later after a vicious counter trend rally that took price to within 6% of the ATH the market rolled and collapsed 20% in about 4 weeks (Chart Below). Additionally, at the top in 1973 we had similar breadth readings (NYSI) as we do now. Such readings are usually bullish but can give false positives with dire consequences. The moment of truth is here for the bulls and since most of the bears and shorts have capitulated my belief is that we will top out very soon and launch into a nice decline into the summer. On Friday I became half pregnant with net short exposure.

![PastedGraphic-1[1]](http://ibankcoin.com/bluestar/files/2016/03/PastedGraphic-11.png)

If you are interested below is Janet’s non responsive response to CNBC’s Steve Liesman’s question “Has the Fed Lost Credibility?”

If you enjoy the content at iBankCoin, please follow us on TwitterWell, let me start — let me start with the question of the Fed’s credibility. And you used the word “promises” in connection with that. And as I tried to emphasize in my opening statement, the paths that the participants project for the federal funds rate and how it will evolve are not a pre-set plan or commitment or promise of the committee. Indeed, they are not even — the median should not be interpreted as a committee-endorsed forecast. And there’s a lot of uncertainty around each participant’s projection. And they will evolve. Those assessments of appropriate policy are completely contingent on each participant’s forecasts of the economy and how economic events will unfold. And they are, of course, uncertain. And you should fully expect that forecasts for the appropriate path of policy on the part of all participants will evolve over time as shocks, positive or negative, hit the economy that alter those forecasts. So, you have seen a shift this time in most participants’ assessments of the appropriate path for policy. And as I tried to indicate, I think that largely reflects a somewhat slower projected path for global growth — for growth in the global economy outside the United States, and for some tightening in credit conditions in the form of an increase in spreads. And those changes in financial conditions and in the path of the global economy have induced changes in the assessment of individual participants in what path is appropriate to achieve our objectives. So that’s what you see — that’s what you see now.

Finally….after the last 2 week crap show from the ECB & FED, someone is highlighting how negative this is for the markets. The kitchen sink ECB and the scared FED are behind the Bus cycle. We are still tracking 2008 price action….

nothing matters .. it’s a globally coordinated effort to inflate asset prices of all stripes, in particular the stocked markets of the world

they will all go up into the stratosphere and then spectacularly crash in sync

let me know exactly when that will happen, until then buy any stocks benefiting from the US security state budget which now amounts to over 50% of collected taxes .. so LMT RTN GOOGL AMZN FB ORCL GD HON MMM etc etc

Good post Blue. I smell distribution and repositioning on these rallies. Escecially as it pertains to energy.

This article is spot on.

Not sure that 9-10 months has to be the case here, but if that is the case again that puts us right in the danger zone currently.

Given the massive short squeeze recently and how we just retook the 50 week moving average… potential for nastiness is elevated.

22 times earnings seems rich to me.

So I have been getting lighter.Funny’

when I tried to sell Google to lock

in nice profits my critics around here

talked me out of it. Something about

driverless cars.

P/C ratio hit under .60: check

NYMO had hit over 100: check

NYSI over 900: check

Over 90% above 50d in SP500: check

10 yr below 2% and 30yr below 2.8%: check ….errr…. wait a minute ….

Market will not head south until the last bond bulls throw in the towel. I am waiting for 10 yr over 2% and 30 yr over 2.8 % to begin selling and/or shorting. And that is beginning today ….

Just wanna say blue.Awhile back you

made a great call on Amazon but I

think your call on Valeant is even

better.Congrats.

Hansa – Sorry but this isn’t the first time someone has mentioned this. In fact I’d say the majority of people in the markets are skeptical / negative.

VIX has continued to get crushed.

Any thoughts BlueStar?

We’re at:

13.8 spot

16.8 APR16

obviously anything @ or near 12 is an instant buy but how long do you see this persisting? is 16/17 low for 30dayVol?

15.4 is the HVG Historic 30day average … so maybe wait for the APR16’s to come in another point?

probucks,

we could top out at any moment. today there was no volume. up volume was pathetic. I don’t think we get a V top but instead a slow slope down and then gradually it accelerates

have a small Vol position on since the beginning of the month. Just a flesh wound right now.

Blue, any thoughts on the below from NDR?

I share your current bearish bias but this breadth thrust really bothers me.

https://twitter.com/NDR_Research/status/712310383030177794

Monte cristo

if we pull back and go above the high we put in here then its very bullish. Has to be a real pull back first.

that’d make a bit more sense to me. good point