The retest of the August lows is on the horizon. The question is do we bounce off and go to all time highs or do we blow through it like butter and seek a new level with much lower price discovery. Personally I believe we have begun a major new leg of the correction last Thursday. I believe the second chance rally is in the rear view mirror and we will begin going lower fast. Above you see a painting called The Scream. The general public should begin doing that soon as we accelerate lower. Liquidity is leaving the building and I can smell liquidation and fear building under the surface. Take a look at the Goldman Sachs Financial Conditions Index below. It should be improving if this rally were for real. Unfortunately it is getting worse and heading back up. I have been stalking this 4 year cycle top for a year. It began in May, made its presence felt in August and is about to send genuine fear and loathing throughout the land. I have shared with you my fundamental thoughts as to why this is happening and some of my technical thoughts as well. In my humble opinion the time is now. A sublime perfect moment of convergence between price and time. I reiterate that I am not giving advice as talk is cheap but I am positioned for the shock and awe that is about to unfold!

Comments »Yearly Archives: 2015

Stay Focused…Tune out the Noise.

I wrote on Wednesday evening late night that it didn’t matter what Janet Yellen was going to say especially given the ramp up into the non-event. We got a text book reversal gravestone doji candle and then follow through on Friday. I expect an inside day with perhaps a small rally day on Monday. This will make the bulls feel good and the bears who shorted the hole on Friday throw-up. Monday will be noise so STAY FOCUSED AS THE PRIMARY TREND IS DOWN!

There was much gnashing of the teeth by the financial glitterati about Yellen’s performance during the press conference on Thursday. Many said she sounded incoherent and exuded a lack of confidence. Perhaps…but when has she not sounded like the Grand Equivocator? I have been listening to this woman speak in tongues for months and it has always been nonsensical kaka. So why now does the market choose to sell off? Again we are in a Bear Market. My point is this: turn off the TV and stop listening to economists, strategists and especially CNBC commentators. We are flipping to a point in the cycle where the pundits will be searching for reasons why the market is selling off and analyzing them ad nauseam. It just doesn’t matter what they say.

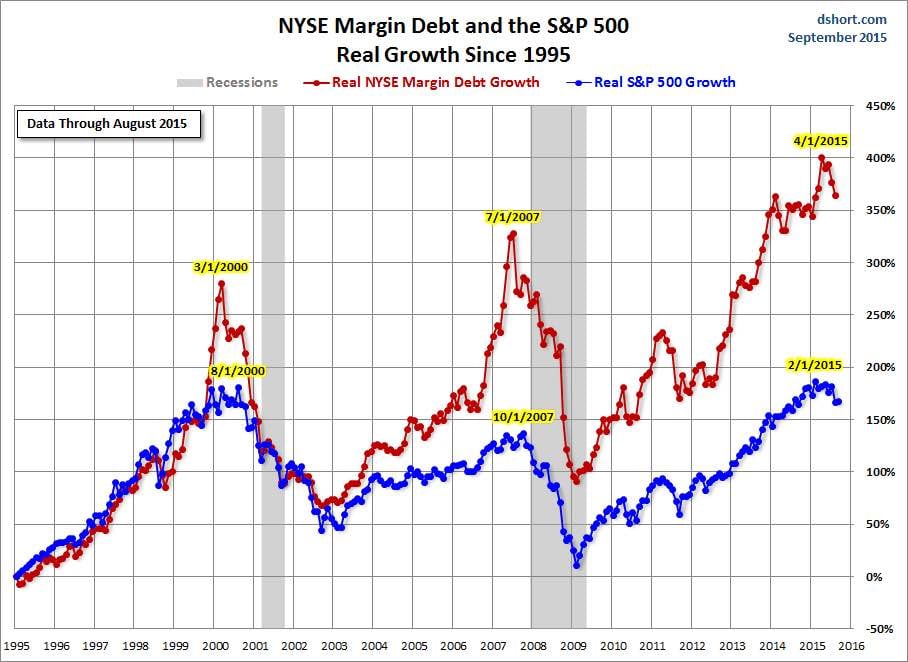

Why are we in a bear market? Well the bottom line is this: The Fed and other CB’s have provided free money to speculators that have levered up to buy just about everything including stocks. The rise in the markets over the last 7 years was jump started by the CBs but was aided and abetted by willing market participants who over time all jumped on board and followed the trend with ever increasing amounts of leverage. Leverage and cheap money are the keys for the Bull market and it is also the fuel for the Bear market. We have seen the emerging markets, commodities and now credit roll over as levered speculators are taking on water. The last man standing was the U.S. stock market and that has begun to lilt as of August. Why are we rolling? Because everything is a cycle and eventually there are no more buyers. We have reached peak margin debt. The truth is there are very few bears short at the top as they have been shamed into humiliation or lost all their money. Once the buyers are exhausted price then tries to seek an equilibrium. As it does so the last folks in on margin get taken out first so that is why the down is always quicker than on the way up. As more margin calls begin the masses are eventually awakened to the issue at hand and they begin to liquidate and some even flip short. We are at an early stage when we really have not even begun to scratch the surface of margin calls yet. Once this cycle begins the Fed and CB’s are powerless to stop it (hint: it has already begun). The most powerful man in finance right now is the margin clerk in the back office. He cares not a whit about what folks on TV are saying or what the Fed might do. Once this cycle begins it is hard to stop if not impossible. Usually it starts off slowly and then turns into a waterfall. In August you got a taste of what is to come. Of course we will not go down in a straight line so one must be flexible and take profits on extreme moves down expecting a bear market rally. However, because of the insane amounts of leverage in the system the chances of a 1987 and 1929 style crash are extremely high so caution is warranted.

The rally we just had was a bear market rally and likely ended on Thursday afternoon. I expect the speed of the downtrend to reassert itself next week. The rally we just had is historically called the second chance rally and is usually the launch point of a crash. I am not calling for a crash but if one were to start then this is the set up where I would be looking for it to begin. Like I said previously, Monday should be an inside day but if we should gather steam from Tuesday on to the downside and start taking out key support I would become extremely cautious. Take a look at the second derivative of margin debt on this chart below. Without margin debt accelerating I see this market going much much lower over time.

I should say that while I am not publicly calling for a crash I am positioned for one. Remember talk is cheap and positioning is all that matters. How is that for an enigmatic statement?

Comments »25 Basis Points…Seriously? Game Over!

Much ado about nothing here really with this 25 bp rate nonsense. Bottom line: Why has the average manager struggled since the beginning of 2014? That was when the QE taper began. After QE 3 ended in October of 2014 the broad market went sideways until the top on May 19th. So without QE the market will continue to go lower and stock picking becomes essentially irrelevant as correlations rise to 1. Raising interest rates or not will not save this market. It really doesn’t matter what happens tomorrow because the bear market is already baked into the cake. You see we would have collapsed sooner except the Fed and Washington commanded our vassal states of the ECB and Japan to carry the monetary baton with their massive QE programs. All that did was to prevent the US markets from imploding sooner. Now we have currency wars and the former cooperation of the Central Banks has turned into everyman for himself. Essentially we have been tightening monetary policy since the QE taper began. The strong dollar has been a signal that we are going to see a global deleveraging. It has begun in the emerging markets and is coming our way and has already begun. So you see this 25 bp debate is noise.

The bear market began on May 19th and the character of the market began to change then as well. The topping indicators I use would form divergences prior to that and would top weeks later. Now we are topping almost simultaneously. The V rally seems to be dead as well. What sealed the deal to make this an official bear market was the the advent of the Dow Theory Trend Change that occurred on August 21. What that means for me is that rallies are countertrend and the primary trend is down. I am not a day trader I am an Investolator. Part investor part speculator. I hold my shorts for longer periods of time and use options to swing around tactically.

Here is the current situation. All my voodoo and chicken bones (technical and cycle stuff) are pointing to this being a countertrend rally within a bear market. Additionally, given the length of this manipulation by the Fed, my initial price target by year end is 1500 on the SPX which is the 2007 top and the level at which QE3 began. We are essentially going to erase the crack cocaine high. It will be quick and violent. I believe the second down move will begin very very soon (test August lows and possibly go to 1700). We are extremely overbought, many of my indicators are rolling over and the Boyz have managed to engineer a short squeeze before this non event. Every Johhny come lately bear wannabe has been squeezed out. Most of you don’t know how to short. To play this game you need to be short before it rolls over. The moves down will be swift and most of you will miss them. I get excited the higher prices go as my indicators peak. I get sad when the market goes lower and I have to cover. I am at maximum happiness right now. By the end of November we should be much much lower. The only thing that makes me scamper away like Gollum is a new QE. I have news for you they are not going to do it. There are geopolitical aspects to this that I care not to go into but I believe the stock market is about to be sacrificed for the bond market.

Remember we are in an equity bear market and it is GAME OVER!

Comments »

The Boyz Set The Trap!

If you are buying here then you are being set up. Trust me the smart folks are selling not buying. The higher this squeeze goes the worse the hangover. I am not sweating at all. In fact I love this action. I will be adding more in size. You have been warned. Will it top today? Maybe but we are close and when we roll it will be quick and brutal. More later.

In case you were wondering who the Boyz are they are our good friends on Wall Street that can manipulate the short term but not the long term. Who is buying all those OEX puts? Hmmm.

Comments »Fear Is The Mind Killer

Watching this market over the last year has been absolutely amazing. I have to hand it to the bulls. You have been a stubborn bunch. I knew I was right this year when I was literally one of the few bears standing. I was abandoned by all except a battle scarred war torn veteran futures trader who refused to go long and would only short the rips, a former convertible hedge fund PM, a Belgian futures trader and my cycles guy Tim Wood. We would hand hold each other through this range trading nightmare. I have a massive levered swing short I put on close to the May top in SPY. I plan on riding it for awhile. I have some massive individual shorts in stock specific names. My shorts are basically frauds. I use index options to trade the ranges (puts in SPY, IWM XBI).

What is amazing to me is the complacency of the bulls, twitter finance and the institutional buy side community even after the break in the Market on August 19th. Most of you believe that the economy is fine and that sentiment is too bearish because of such and such an indicator and that we will rip higher because the CB’s have your back. I am here to tell you to throw all that crap away. You all are about to know what real fear is like. I, and my compadres, believe that after this rally completes (highly likely it has) we will begin the real move down. I expect the market to implode an additional 15-25% by the middle of October. I believe that move has either started or will after one more squeeze higher into next week.

Why do I know this? Because we have seen the statistical set up complete on Friday August 21st that has been seen at every major 4 year cycle top. I also know that when the 4 year cycle top is in the first move happens quickly and is deep. Due to the excessive money printing and demonic stretching of the cycle the correction will be ungodly in nature and rip most peoples faces off (think 1929 or 1987). You see when you mess with mother nature and alter its path there are unintended consequences. The amount of debt that is going to be delevered is staggering. I usually do not buy lotto puts but I did buy some today at the top of the move at ES 1969 resistance. I think we see SPY 170 by the middle of the month. I have laid out the fundamental case for this top in all my previous posts and now we have the statistical set up that has completed. I know that the trend has changed to bearish and when the other 95% of you figure it out that’s when we get the OMFG moment and the losses really begin to pile up.

Most folks are still not positioned short nor think we will go much below the low of last Monday if we get there at all. This time is different. I suggest as you are freaking out that you refer to the wisdom of Paul Atreides of Frank Herbert’s Dune series below.

Comments »

We Will Undercut The Lows!

It looks like we will eventually take out the lows from last Monday. I have been quietly watching traders on twitter trying to nail the low. The BTFDs keep running into brick walls and their foreheads are now bloody. Let me help you out here. The selling you are seeing is not some futures trader with a big PA or the Wall Street Boyz having algo fun. This is big boy institutional selling. In July I warned the MOU Hedge Fund fellows it might be in their best interest to skip vacation this year and get a head start on everyone else. I can actually hear the helicopters lifting off this afternoon from the Hamptons after their CFO’s called to say “Houston we have a problem!” and the CFO’s said to the MOU’s that they needed to get their asses back to the trading floor.

All sorts of trend following strategies and risk parity folks are taking gross down as fast as possible. This is just starting to get interesting. Not to mention all the Sovereign Wealth Funds and CB’s who just loaded up on stocks and now have to dump them in order to stem the petrodollar’s demise or defend their currency from capital out flows. Trillions of Dollars of financial assets need to be sold. This selling should take a while and will become self perpetuating just like it was on the way up. This is what we call reflexivity to the downside. STFR replaces BTFD.

We have a primary bearish trend change. There will be bottoms and rallies along the way. A real bottom is not likely until November Or December. There is an outside chance we see 1700 S&P by Friday. Yes that is not a misprint. However, we may rally tomorrow but I am confident we take out Monday’s low sometime soon. Good luck all! If you are a trader stop trying to nail the bottom. Its now easier to short the rips. If you are a long only investor and not a trader its time to raise cash and reduce your beta. All others should step to the side and raise as much cash as possible.

Comments »Kid In A Candy Store

I am besides myself looking at all these broken charts and emerging bad fundamentals. I am like a kid in the candy store. I am adding to my stock shorts with the profit from my index puts. We are done folks! This is not like October of 2014. The volatility regime has changed and a techtonic shift has occurred beneath your feet. Friday August 21st was was the Financial equivalent of 9/11 in the S&P 500. The world changed that day and the great bear market of 2015 has begun. The Bulls do not realize that the power has shifted to the bears. Quite frankly the bears who are left don’t know it either.

I am not going to waste time today describing why the bear market has arrived because I have done so for the last year. All that I have been writing is coming to pass. Instead I offer you expert advice as a former large cap growth manager. When bull markets die momentum stocks die with it. Energy and materials have been pounded into the ground over the last year while tech and health care became the last bastions of this bull market. Momentum as a factor died last Friday and now we have broken parabolic structures. Never short a parabolic structure until it breaks. I picked up quite a few puts today in XBI after a perfect 50% retracement from Mondays low. That chart is done, its over…finished. It is a classic bubble that just burst. The chart is broken. Many of the companies in that index have midcap valuations on their way to small cap status or zeros. I think this is going to happen very quickly. I see potentially 40% downside over the next three months. Here is the key in addition to the broken chart: Momentum stocks need to catch up to energy stocks or what we call a mean reversion. Notice how oil ripped up 10% today. People think that is positive for the market. I am hear to say its just the hedge fund pain trade as the consensus hedge fund is long Momentum and short negative momentum. Now that the general market has broken the haves will become the have not’s and vice versa. I will add to my position on strength and press should it begin to roll. But essentially Biotechs are over IMHO.

Comments »STOP THE PRESSES!

I just got a frenzied call from my secret weapon! He is a farmer in Belgium who is one of the best chart guys I know. He just informed me that a potential set up of impending doom may elect tomorrow. He told me to not sell my puts or cover my positions. Unfortunately I did but I will pull a 180. If we see what we need to see I will be going huge again into puts and in particular a certain sector put. I will post if I get involved. I can only say with a heavy heart that my Farmer friend thinks the real panic is about to begin. If you are long anything I would suggest that you need to seriously reconsider.

Comments »I HAVE BANKED SOME $$$

No need to be greedy but I took a lot off as we ripped today. I have banked some cabbage that I stole from The Fly’s account these last few weeks.

In all seriousness the bear market has begun. We will get a ripper of a rally or we may retest the lows but make no mistake things are different now. I think the crash scenario is off the table at least on this leg lower. High yield spreads are tight and will be getting tighter. My exposure has been taken down from insane margin levels to short a few single stock names and a little short the SPY. No options as Vol will come down and crush them. I will reload on the sucker rally and the high-fiving by the bulls. I am going to execute this plan over and over again until the bottom. At the bottom a few years from now I will post this song and flip long. I am trash talking at the request of Jeff AKA OA.

Comments »

What Next?

Good news for bulls!: My best guess is a flush on Monday/Tuesday then a two week rally. Bad News For Bulls!: I believe the rally fails and we ultimately go below the 2009 low as we are seeing the four year cycle top. Not 100% sure but I am pretty sure. There is a small chance we could crash from here but only very small.

This weekend I will write a piece that will alter your perception of reality. There is a lot going on behind the curtain. We truly live in very deceitful times.

Comments »