This correction that began in May will not end until we find the cockroaches. What do I mean by that? I mean every credit induced correction does not end and bottom on no news like we had the last week of September. Markets bottom on bad news. So where is our bad news? In the 1998 analogue we bottomed much lower percentage wise and after Long Term Capital went bankrupt and was saved by the Fed and a consortium of I-Banks. In the first part of the Financial crisis in 2008 we did not bottom until Bear Stearns went bankrupt. In 2011 we did not bottom until coordinated CB action was induced to save Greece. Have we had any coordinated CB action yet? No!

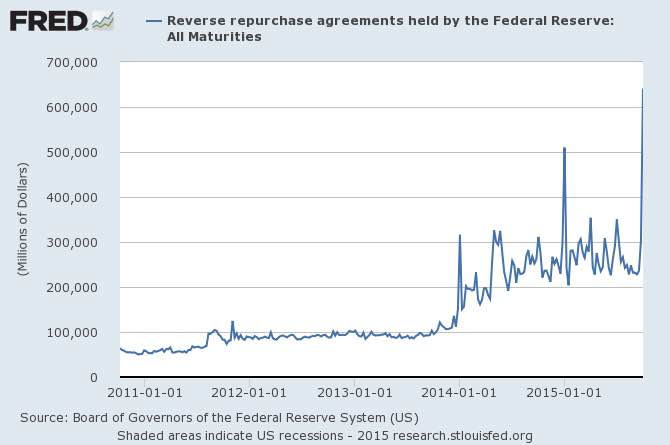

Behind the curtain is an absolute mess. I believe that the CBs are participating in behind the scenes support of large financial institutions. How do I know that? I watch asset prices and commodity prices which suggest massive derivative losses have occurred. Also the BIS and IMF are basically telling you that a crisis is coming if you read their press releases and cryptic statements. Additionally, the Fed has been engaging in exponentially rising reverse repurchase agreements. I sold Repo when I was a bond salesman back in the day so when it comes to Repo I know what I am talking about. The Fed has been releasing collateral in part I believe to settle margin calls on derivative bets gone bad. Treasuries are the preferred security for margin collateral posts. Look at the below chart that has been circulating around and talked about on other blogs:

Some of the increase is explained by past Fed press releases stating that reverse repos would be used to help unwind accommodation. So yes these occur at quarter end for legitimate and non-nefarious reasons. However, I find the spikes in December and September which are 2x the other quarter end spikes to be very interesting. The common denominator for both was Oil which was heading to new lows and was below $50 a barrel at the end of Q4 2014 and and Q3 2015. Also we had Equity market swoons occur then with the VVIX (vol of the vol) spiking. So essentially someone is exposed to sub $50 oil in a massive way that requires insane amounts of collateral to be posted. The cockroach is likely one or many institutions that wrote derivative contracts back in the day when Oil was $100 a barrel. Who is it? Glencore? DB? GS? JPM? I don’t know nor do I care. This ends when one of these or multiple players gives up the ghost and dies. I am guessing its not GS as they are calling for $20 oil and likely trying to feed off the corpse of the victim. The bottom line is the counter party risk is immense here and it threatens the system. This equity market sell off bottoms when we see a bankruptcy.

So where does that leave us today? Oil sold off hard all day and the VIX and VVIX appear to be bottoming. On Friday the SPX Put/Call ratio collapsed to lows not seen since December of 2014 and the NYMO was over 100. I expect pain and new lows soon. This recent rally, as spectacular as it was, is a bear market rally and until we see a cockroach emerge all rallies will be counter trend.

If you enjoy the content at iBankCoin, please follow us on Twitter

what a disgusting picture. I bet you keep pet roaches in your house

Blue,

Excellent observation. Somewhere there will have to be a black hole that will need to be filled just like in the past. BSC balance sheet was shit and couldn’t buy a mouse trap. Maybe its DB this time around? maybe need to follow the money and see where the bets are placed, and which other FI stands to benefit the most. In the meantime, we wait.

Fly,

My cockroaches are Jurassic Park size as they come from the jungle. I fear for my 3 pound dog.

The rally in oil we just had gave the US based drillers a chance to sell 6 & 12 months out at 50 – 60. Keeps em in business till April when they’ll do it again. I’m not in the business. Does that sound logical? I see lower oil from end of October through March. Not in a straight line of course. I believe Goldman will be proven correct.

nocturne,

yes i think you may be right.

Thanks blue… 2 things… 1) in your opinion, what caused this sell off? Credit spreads widening? China weakness? Markets pricing in larger than expected fx headwinds and earnings recession? No one I know can point to one thing… So why must there be a solution, like a large participant in distress? While I would typically agree with your logic, in this case, for the above reason, I don’t… Though maybe it is a function of the roaches hiding… 2) I work in a BB (AM- side) and used to work in a diff one (IB-side)… From some of the credit flow I see, I don’t think anyone has stupid e&p exposure… From what I see and hear, Jeffries has the most relative risk; and quite frankly, I doubt they are big enough. Appreciate your perspective as always.

Also, recent regulation limiting lev loan max leverage of 6x has resulted in either creative adjusted ebitda math or deals being pulled… Primarily the former, though it has limited some of the market’s insanity.

Anyone who says oil will never hit $75 is a moron or doesn’t really understand how long never is.

From what I hear oil will continue down. Don’t know about $20, but anything is possible.

Rick Rule says the lower it goes the more production destruction (my words) there will be.

And the longer is stays low; the higher it will go when it eventually snaps back.

There is no productive capacity switch to flip back on when demand rises, even a little.

In Arizona, cats & small dog owners fear the coyotes.

They jump the backyard fence; grab Fluffy, and away they go.

Bye Fluffy.

In Florida, it’s the gators. The reason everyone’s pool there is screened in, is to keep the bugs, snakes and gators out of the pool.

US forecast for oil down 100,000 bpd in the coming months – not all that significant but a dip nonetheless. Iran oil coming into the market provides downward pressure. Overall supply continues to grow faster than demand. I don’t think we hit $75 oil for 2 years.

The House voted to lift a ban on US oil exports a few days ago. I’d be willing to bet Obama opposes it simply because republicans are proponents. That is how juvenile these politicians are.

I wonder sometimes how much bad debt BX has on their books as it relates to drillers and oil exploration.

Bluestar, what’s your view on a potential debt crisis in 2016 within the energy sector?

Isn’t likely an insurance co. wrote those massive derivative

contracts -say Aeg

DJMARCUS,

QE and Cycles are the cause. I am not saying once cockroach is found we are ok. I am saying that we will have a nice bounce for more than five days.

jts5362,

We are currenltey in a crisis that will end with many distressed pieces of paper and some will go to zero.

Gorgy,

Yes and IBANKS or commodity firms as well.

Just watch the dollar, that’s what’s being squeezed ever higher, and we’ll see 115+ before this cycle turns, then down to sub 50.

Long wait til oil rises in dollar terms, and the rest of the world will move to euro pricing as the cycle turns in 2020 anyway.

Blue,

Same question: How does a good short seller game the coming QE4? Do you sell all your shorts before each Fed Meeting or minutes? How do you keep from being decimated by a QE4 announcement.

Answer from Fleck: “There can’t be any new QE until the market cracks first, so nothing to worry about Fed-wise until that happens.“

anecdotal,

Fleck is right. I cover after a nice crack.