Yesterday we got our 4th confirmed Hindenburg Omen signal with all the others occurring over the last two weeks. We had a similar occurrence in September last year before the October swoon. A Hindenburg Omen is not a timing tool nor does it mean a crash will happen. It simply means that a correction of 15% or greater has a 25% chance of occurring over the next four months. So the window is between July and October. In fact all corrections of 15% or greater over the last 30 years save one have had an Omen signal precede the correction. Stated another way the pre-conditions for a big correction or a crash have been met and the clock runs over the next 4 months.

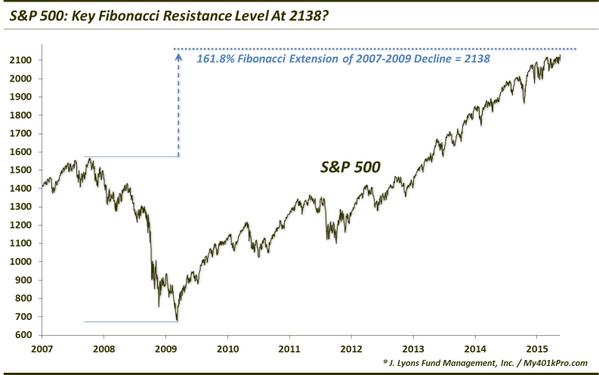

Most of you know I am a bear and I have been positioned as one for many months. I have margin ammo to add to my positions should I gather more confidence. At the very least for you bulls this should serve as a heads up that the underlying market internals are not healthy. My belief is that this is the most dangerous stock market we have ever seen since the inception of the Dow Jones Averages in 1876. The Global Central Bank manipulation has extended this cycle 13 moths longer than the previous record of 60 month advances which occurred in the bull market tops of 1987 and 2007. Cycles can be stretched but not denied and I would contend that manipulation makes the hang over that much worse. The market is having trouble here at its 161.8% Fibonacci extension form the 2007-2009 low. The 161.8% Fibonacci level is the Golden Ratio in nature and I suggest the market will have a very difficult time making it through this level in addition to all the fundamental headwinds that are beginning to appear.

I am not recommending you short this market today as we could make marginal new ATH’s from here. However, I think the risk reward is very skewed to the downside as we are now in the crash window and 13 months beyond the previous 4 year cycle advance record. View this post today as a Public Service Announcement rather than a prediction or a recommendation.

If you enjoy the content at iBankCoin, please follow us on Twitter

Bullish

Funny, I was just talking about this 161.8% fib resistance a few days ago. The upcoming Grexit may just be the beginning of the end. So pissed at myself for covering shorts at the end of the day. Not an hour after the end of AH futures trading Tsipras calls for a refendum. Please please please don’t gap down too much on Sunday.

I think Blue is right. One more push to ATH then the move lower. Just seems like everyone anticipating this – not happening yet.

This month after month narrow trading range I suspect is having the effect of conditioning many of those with a bearish bent to cover on every 3% dip just as the bulls are busy getting long waiting for the inevitable 3% pop and then rinse and repeat. One of these times it very well might start the usual bottom of the trading range rally and then turn right around and blast right through the lows and probably leave many bears completely flat footed. That should be fun.

Look, I realize this source is a crazy permabear, but this scenario blows my mind. 74% crash? I mean wow, seems crazy. I do think the market is going to crash eventually though, but 74% seems excessive. His timeframe lines up perfectly though with Armstrong turn dates and the coming sovereign debt crisis this fall.

If we break out to new highs and fail to hold on a retest then the crash scenario has validity…a correction at the very least.

http://www.zerohedge.com/news/2015-06-27/does-1987-have-any-lessons-today

Kinda related, do you think Deutsch Bank is exposed to Greek debt and that’s why it has been having so many management issues and a less than stellar chart. Could be a great short if that is the case.

sort of feel all this is only the fifth inning.

DOW expected to gap down about 300. Dax expected to gap down about 4.5%. Wow.

Wow they gapped the /ES below a critical level at 2062. Going to run it down to 2035-2040 area. The top may very well be in.

Shorted the /YM down -280. Feels insane, but we gapped below key levels and /YM has the thinnest structure underneath. Looking for 17150 from here. Would return around $2,000/contract.

Hello all,

lets watch the important 2040 level. Until then bears got nothing in the S&P.

helicopter ben,

I am stalking DB short like a hawk.