Code Rebel (CDRB) a Maui based enterprise software firm had an IPO on May 19th. The stock was sold through Burnham Financial and they priced about 1 million shares at $5.00 to raise $5 million. Since the IPO the stock is up 640% and currently sports a $450 million market cap. Their revenues and losses in 2014 were $223,000 and $679,000 respectively- a mere 1,800x Revenues. Their premier product is iRAPP® terminal services products that allow users of Windows-based personal computers (“PCs”) and Apple Inc. computers (“Macs”) to simultaneously access programs on their PCs and Macs through a single device using a single monitor, mouse and keyboard. They claim they are the only working product on the market but site Citrx, Microsoft, VMware and Red Hat as competitors. Last time I checked they are not shabby competitors.

So what is wrong with an enterprising young CEO tapping the capital markets to raise money to grow his business? Absolutely nothing, except this should not be a public company. This is an early stage company that should be in the portfolio of a VC fund. Why didn’t they go that route instead? Maybe because they couldn’t. In the DotCom era IPO’s of venture capital stage companies were routine at the end of the cycle. Most of them were zeros once the capital markets closed.

Code Rebel qualifies as an emerging growth company which allows them to skirt a host of reporting requirements (buyer beware).

I found out about the company from a friend who is a software engineer on the island and he asked is this legit? Yes it is likely legit in that it is a legal company and is registered with the SEC. Is it worth $450 million? I will let you all be the judge of that. I will provide some pieces to the puzzle that might suggest the valuation borders on the absurd and insane.

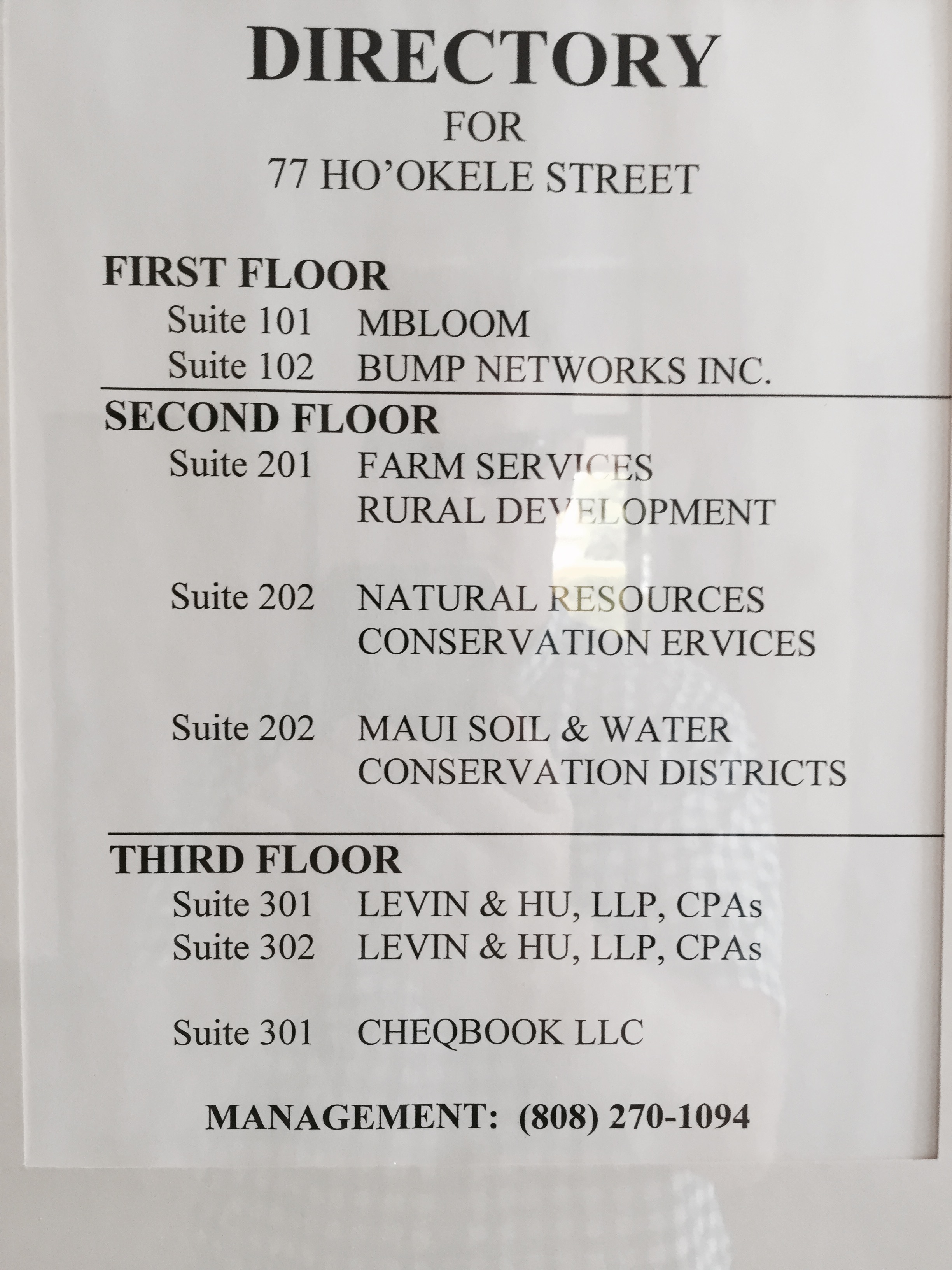

Arben Kryeziu is the CEO of the company but he is also the CEO of Bump Networks which apparently shares the same address and offices as the public company Code Rebel. From the SEC filing of Code Rebel the address is:

Additionally, the CEO was embroiled in a bit of controversy on the Island of Maui which may have pushed him into the very accommodating public markets via Burnham Financial:

http://www.bizjournals.com/pacific/news/2014/07/17/maui-fund-mbloom-in-conflict-of-interest.html

And finally last week the CEO Arben was featured on Fox Business Making Money with Charles Payne. They were waxing philosophical about tech disruption, VC markets and Arben’s company. Arben plans to use the $5 million to expand his business and roll up other companies. When asked about profits and revenues he was rather modest in that he said he could not disclose. Funny but I thought he filed an S1 to IPO. However, he did say they will be on the path to profitability shortly. Charles asked “Your are not VA Linux?” In case you are not familiar with LNUX here is the wikipedia description:

VA Linux Systems took its stock public in an initial public offering (IPO) on 9 December 1999, under the stock symbol LNUX. The IPO offered shares at $30, but the traders held back the opening trade until the bids hit $299. The stock popped up to $320 later in the day, and closed its first day of trading at $239.25—a 698-percent return on investment. However, this high-flying success was short-lived, and within a year the stock was selling at well below the initial offer price. As of 2005, this was still the most successful IPO of all time. The stock price reached an intra-day peak of 54 cents on 24 July 2002. It then soared more than 1,000 percent to an intra-day high of $6.38 on 11 September 2003. As of 26 November 2006, the stock closed at $4.64.

You can tell Charles and the panel had no clue who this guy was or the fact that CDRB was trading at 1,800 times revenues. They should have at least pressed him for some revenue figures since he was already public. At the end of a long Bull Market people don’t do work or really care anymore because making money is so easy. Charles needs folks to fill the chair. Arben was only too willing. You can be the judge on this nonsense but if I look out a year this is trading sub $5.00 unless I am missing something. I would not short this just yet as the float is thin but put it on your radar screen. The bull market is aging and just washed up on the shores of Maui. Below is the Fox Video of Arben’s interview. Arben speaks in the beginning and again at minute 10. Enjoy the farce that is our capital markets.

If you enjoy the content at iBankCoin, please follow us on Twitter

Blue – from what I could gather, the market cap of CDRB is 450 million, not half a trillion! But what’s a zero between bulls, bears, reality & fantasy, friends and enemies

Nice catch. Duly noted and changed. Still absurd.

Great post.

*hat tip.

maybe still absurd but only 1/100th as absurd, which seems statistically significant

Juice,

I knew it was 1/2 a billion. but i think you should buy it.

Yeah. This guys a one man snake oil salesman. He is not confident.

Blue,

Another excellent post. Thanks for sharing.

The jobs indicators have served me

well these past few years,keeping me

confident in my bull thesis. There is change afoot though as at one time

you needed to be white and bright to

get a job_-see mad men for reference-

now its the young and educated. Employment levels for this crowd is through the roof and I’m wondering

if the shortage of these in demand workers is leading to hoarding and

screwing with my indicators. This

matters to me as I don’t want to

be last out the door as the scammers arrive to pick the last bits.

Lost 20% since you called it out the other day, nice.

http://kingworldnews.com/the-publics-illusions-are-about-to-be-crushed/

For King World News, the end of the financial world if not the end of civilization, is always imminent

Juice I agree, they are like a broken record, especially with their end of the world headlines; however some of the interviews are of quite good.

No one knows what the future holds. Everyone will most likely be wrong,

http://usawatchdog.com/wave-coming-too-large-to-duck-under-warren-pollock/

anecdotal – and I agree with you; some of the interviews are good, amongst all the end of worlders, armageddoners, conspiracy crackpots … but sometimes it’s like reading the bible, you have to cut through a lot of chaff to get to the wheat .. I’ve read that maybe 10-15% of the bible is fact, that may go for many sources of info as well

Hello all,

Thanks for you comments. The frogs appear to be boiling. We are approaching a tradable low. However, IMHO this market is looking more and more cooked by the day. We have a Dow theory non confirmation, a NYSE non confirmation from the A/D line. We only need structure to confirm and when it does the 4 year cycle top is in. Stay tuned. Bulls still have a chance to save this but the longer term time frames look awful.

Blue

It feels like the track right now.Bets are

in and all are sure of the outcome.

Charlie Payne and his bud Toby Smith operate 2 of the larger Pump n Dump organizations out there.

I always read Bill Fleckenstein’s comments; never James Turk’s (a broken record or broken clock)

http://kingworldnews.com/bill-fleckenstein-global-rout-in-bonds-eerily-similar-to-period-that-lead-to-1987-stock-market-crash-plus-a-bonus-qa/

Another few years?

https://www.youtube.com/watch?v=ZGJe3AemijE

Divergence & drought

http://kingworldnews.com/richard-russell-warns-the-next-mega-disaster-is-already-in-progress/

And old man bank

she must know something

but won’t say nothing

she just keep rolling along.

Blue,

Any thoughts on $TWTR long term without its Dick?

Much love,

OA

Bluestar,

in relation to the WMT and PG charts…do you think CLX is a possible short candidate down to the mid $80’s? I’m looking at the 10 year weekly charts with the 50 and 200 ma’s.

Blue, didn’t you like $LF ? they’re blowing chunks over earnings .. you still think there is value there at $1.50 ?

Read about this Axovant (?) IPO and thought of this post. Starting to see some real excess in this market. Could be just the beginning though. $AMBA is an amazing short. Got to scale in though.

OA,

I still like twitter long term. However, as you and I know it requires time to heal the chart.

matt_bear,

All staples are immensely overpriced. I think its a short.

juice,

I clearly was wrong on that one.

Quality Control inferno,

I have been amazed at the duration of this bull. We are very close.

Well CDRB is still holding up fairly well and if we could only have bought that IPO…..I have a source that tells me that DSGT may be Burnham’s next project….and if so hang on for the ride.

Peter Brown.

Thanks. The price holds up because there is no float. That will change.