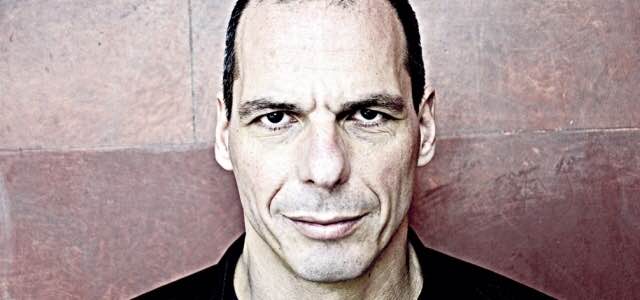

I thought this Greek election issue would have been on its way to irrelevancy by now for global markets. Usually a party promises its people one thing and then once in power they pivot towards the establishment. Greek bond spreads have done nothing but widen this week because the New Greek Finance Minister, Yanis Varoufakis, is talking tough. At first I thought it was nonsense talk initially but as the Greek bonds imploded I investigated further. Apparently this Yanis is a very serious man as written in the FT:

“Greece will no longer co-operate with the “troika” of international lenders that has overseen its four-year bailout programme, the country’s finance minister said.

Yanis Varoufakis also said Greece would not accept an extension of its EU bailout, which expires at the end of February, and without which Greek banks could be shut off from European Central Bank funding.

“This position enabled us to win the trust of the Greek people,” Mr Varoufakis said during a joint news conference with Jeroen Dijsselbloem, chairman of the eurogroup of eurozone finance ministers, who was visiting Athens for the first time since a leftwing government came to power this week.”

Below is a BBC Interview with Yanis. The first 3 minutes set the BBC narrative so skip to minute 3 to hear Yanis speak.

Yanis is an academic and an economist. I think the ECB will have their hands full negotiating with this man. He wrote a book on Game Theory (Game Theory: A critical text. London and New York: Routledge, 2004). He is also a blogger (http://yanisvaroufakis.eu) and says he will continue blogging even though he is Finance Minister and pressure has been put on him to stop blogging. He also tweets @yanisvaroufakis. The next date to watch is February 28th as the current bailout program for Greece expires and needs to be renewed. So basically we have a month of negotiations while the capital markets are wobbling. This should make for a very volatile month. Watch the Greek bond spreads as they will tell us if Yanis has begun to cave into the EU demands. However, my gut is telling me this man is different and he just might surprise us while the market consensus is that Greece will fold to the demands of the Troika.

I like this man…..he has Balls. Its like the movie “300” when the Greek King Leonidas tells the vastly superior Persian forces that he will not bow. Unfortunately for us the next month is all about Greece news flow unless this gets resolved quickly. After what I learned about Yanis and watching him in the BBC interview I have serious doubts that this will blow over soon.

The canary is dead long live the canary. The debtors prisons were the only prisons back in the day. Then bankruptcy was invented. There are some huge losses coming. Will a trillion from Draghi be enough? Without a doubt there is a chance Greece will stop digging as it tries to get out of a hole.

Yeah, I like him as well. And a typical one-dimensional incredibly annoying journalist trying to nail him down into a corner to get some sensational headline out of the whole thing. I just wanted to wring her neck. She had no interest in what he was saying. Good for him for calling her rude. Indued!

Boring

He really keeps hid cool with the BBC reporter as she tries to corner him with simple yes/no response.

I would be surprised if there is no resolution by the deadline, but his posturing should spike the vol.

Many demonstrating in Spain yesterday looking for a greek like solution.

Armstrong may just be right.

The BBC report implied that the structural reforms that were the big sticking point in negotiations were of the candy-for-the-masses variety (e.g., minimum wage raises). But it is the sale of Greek infrastructure on the cheap to foreign shoppers that they’re looking to halt.

Anyway, the guy should avoid flying in small planes.

This is what I heard.

He won’t be boxed in. The firesales are over and if Greek is bankrupt then write off the debt please.

Blue,

What if Varoufakis is just pulling a classic “chicken” game theory tactic by effectively showing the ECB that he threw the steering wheel out of the window, as debt negotiations near. As a Game Theorist, this tried and true tactic certainly has crossed his mind. Just a thought. I hope that he is not just bluffing, because I believe he is fundamentally correct that the problem is one of insolvency not liquidity.

Anyone have thoughts on CLH5 and 8% spike in final hour Friday?

I have been short and think it a counter-trend rally but can’t ignore the wisdom:

“Markets are never wrong, opinions often are”

Thanks

Exit was long overdue. Never should have entered. Now their recovery can begin in Ernst.

Dr. Fly,

Thanks for the endorsement much appreciated.

purdy,

I had the same thought.

Billiejones,

I really have no idea what is going to happen but I went from thinking business as usual to maybe this guy is different. We will see. His boss has already backed away from his comments this weekend.

IW40,

It was options expiration on fro day for Oil. It should be interesting to see what happens. A bounce would be counter trend, however how high is a mystery.

The last time WTI crude volatility was this high (08/2011 – 10/2011) as measured by the ticker OVX, the futures contract moved 10% in a day a few times. Based upon this, I consider Friday’s move to be within the boundaries of priced in volatility. During that period, the consolidation before the trend reversed higher was about three months.

Great interview, errr explanation by him.

I heard a story about a Khrushchev? interview. The story goes that he asked the reporter, are you reporting the news or making the news?

The guy’s a Greek patriot. If he doesn’t disappear it means the Euro unwind is underway in earnest. It will be interesting to watch.

anecdotal,

Former Assistant Treasury Secretary Under Reagan and former associate editor of WSJ wrote this about Yanis today: http://www.paulcraigroberts.org/2015/02/01/greece-attack-pray-yanis-varoufakis/

BlueStar – the problem I have with Paul Craig Roberts, Mr former this, that and the other thing, is that he’s a lover of the conspiracy theory and often to such an extent that he’s clearly hanging off the highest limb of the highest tree, therefore while he may be correct, it’s a matter of the Boy Who Cried Wolf or there’s about as much truth in his body of work as there is in, let’s say, the Bible, which amounts to some 15% give or take.

In this case, I agree with what Paul Craig Roberts says in that article. I think because Yanis will not go quietly, a plane, train, car or a good old food poisoning accident is likely. If not, maybe a damaging story about his dating habits, lifestyle, etc. will break.

Great interview, actually makes me much more hopeful that Greece will be pragmatic through all of this. That BBC reporter has a brand new job waiting for her at Fox News, she’ll fit right in.

BLuestar,

Have you taken a look at the picture that Roberts uses as his signature? Good god, that man must be senile. Who makes a picture of himself hugging cats as his headshot?

If anything is worth watching these days it’s the currency markets. Very interesting to see the central bankers trying to maintain power. Australia pulled a stunner tonight with it’s rate cut. Only 7 out of 29 surveyed economists expected a cut. There is a huge bubble out these just waiting to get popped. I don’t necessarily think it’s stocks quite yet (although the markets looks pretty iffy lately), but rather bonds. NIRP and ZIRP will only be tolerated for so long.

Did Yanis cave?

He never caved, he just didn’t have the position of stark raving lunatic like the media tried to portray him as having to begin with. He wants debt swaps. Extend the maturities, get the punitive Germans off their backs so they can have some breathing room. It’s better for all parties, and based on the flow of credit into the Eurozone, it would appear that investors are beginning to agree as well.

Forget alpha,

He clearly Mr. Roberts is insane but he is right. Now he is doubling down. Check this out: Hysterical hyperbole or grim reality? http://kingworldnews.com/paul-craig-roberts-new-greek-government-may-assassinated/

Yanis should not ride his scooter to work lest he have a nasty accident.

Juice,

What forgetalpha said. I think the ECB plays hardball because he proposed this and they think now he is now weak. Prediction: he flips them the bird. Markets blink badly and the real negotiations begin. Right now this os a pretty dance.

Juice,

He may be crazy but he was in the halls of government. I used to think many people like him were nuts. However, the longer I play the game I realize the game is dirty and rigged. I saw it first hand at my old shop. Scumbags everywhere.

They may do it blatantly to make an example of the Greeks.

Do you think those in the press did not react to this: https://www.corbettreport.com/crashes-of-convenience-michael-hastings-video/

Actually, I think he made a savvy deal if what I heard is correct in that Greece will begin paying off its debt only if and when their GDP is growing at an agreed-upon, preset percentage.

ya know what, I like this guy Yanis – he’s a man of intelligence, practical experience-wisdom, no bs, problem solving and of peace. Good for all humanity.

juice,

I agree. I like Yanis. Lets see if he gets bought off.

Nice call on $TUR

Sooooo, now Yanis gets to see how he plays in the big leagues. Will be interesting to see how the Greek banks fare in the morning – there was already a small bank run on-going…..could lead to liquidity issues if this expands

oooooooo. I felt so stupid. Should not have been bullish after watching that video. If I were Yanis, I would take all of the capital he could control, and buy puts and shorts this next 3 months. Those profits should pay for Greece problems.

What’s the path of least resistance in the end? It’s to restructure Greece’s debt while ensuring that structural reforms are ongoing. Alleviate the punitive measures the Germans insisted, which in hindsight were excessive, and arguably indiotic. How can a country without access to capital markets possibly grow while capital is fleeing and the weight of the EU is stomping down on its neck. The Germans are starting to see the writing on the wall, and if you don’t think that the ECB initiating US style QE wasn’t implicitly signed off on by the Germans then you arent paying attention. Will there be volatility? Sure. Could we go lower? Of course. But if you’re idea of an investment strategy is to continually bet against the biggest market players in the world (central bankers) then I feel sorry for your portfolio.

ForgetAlpha,

Its been virtually a one way market for 6 years. What is different this year? Dollar has gone straight up in the last six months and commodities have crashed. But hey maybe you are right and the CB’s are omnipotent.

The possibility that the talked-about ‘final blow-off phase’ for the markets remains a distinct possibility.

Buckle up. Keep your eyes on the road, your hands on the wheel and your portfolio on the eject button, either way.

BlueStar,

Clearly the market can and will (and has) gone lower. I just don’t think that means one has to move to all cash or speculatively short. The only reason to do that is if you see a high risk for a major exogenous event that would freeze capital markets (like 08) or a major downturn in the business cycle. I don’t see either of those things happening. I see central banks supporting capital markets which are flush with liquidity (opposite of 2008), repaird balanced sheets, and business cycles which are slowly growing or stagnant in most developed countries. Until either of those two change, stocks should continue climbing the wall of worry. This doesnt mean we wont have a 10% or even a 15% correction at some point in the future…we’re going to have multiple of those. But my overarching point is that postitioning your entire portfolio in anticipation of that event doesnt make any sense. Central banks may not be omnipotent but they certainitly have a direct influence on capital flows and investor risk appetitie, and right now, both of those are still moving in the right direction.

When the dollar was crashing, all of the bulls pointed to it as proof that we were doomed. Now that its ripping, the bears are pointing to it as proof that we’re doomed. Can’t have it both ways.

Edit: When the dollar was crashing, all of the BEARS pointed to it as proof that we were doomed. Now that its ripping, the bears are pointing to it as proof that we’re doomed. Can’t have it both ways.

Forgetalpha,

I never said anything about the dollar crashing. never ever ever. The dollar going up is the sign that global deleveraging has begun. Don’t lump me in with gold bug folks and dollar crashing folks. I am on record in an interview saying the dollar would go up on 1/23/2014.

Bluestar,

Fair enough…my main motivation for arguing against excessive pessimissim in the markets is due to the effect that gold bugs, Fed haters, and dollar crashing folks have had on the average (and plenty of institutional) investors. Unfortunately, they have already left their mark by keeping a good portion of people underinvested in equities and over invested in low return vehicles. Ironically, now that interest rates are at all time lows, the big wave of fixed income investors to equities might actually happen. I think that will cause the blow off top that everyone is saying we’re going through now. That’s when equities will have run the last leg of this bull run, and I think we’ll get the downturn your waiting for. I’m not betting on that now, because I have no certainty of that ever happening, just like I have no certainity that global central banks are running us into the ground. If my recession and business cycle indicators turn down along with capital markets, then I’ll change my tune. But I don’t see that yet, and instead focus on investing in high quality cash generating companies that will compound returns, because even in the event of a correction, I’d want to own those companies anyway. Day trading is fun, and calling tops and bottoms can be fulfilling, but for the average investor, it’s just an easy way to lose money or miss out on solid returns imo.

Forgetalpha,

99% of the time I would agree with you. The powers that be have really fucked this up for all involved. Maybe we get a blow off top. Its is late and we can debate another time. Corporate earnings are about to implode.

Yanis has been thinking about this for awhile

https://www.youtube.com/watch?v=CRRWaEPRlb4

anecdotal,

Thanks for this.