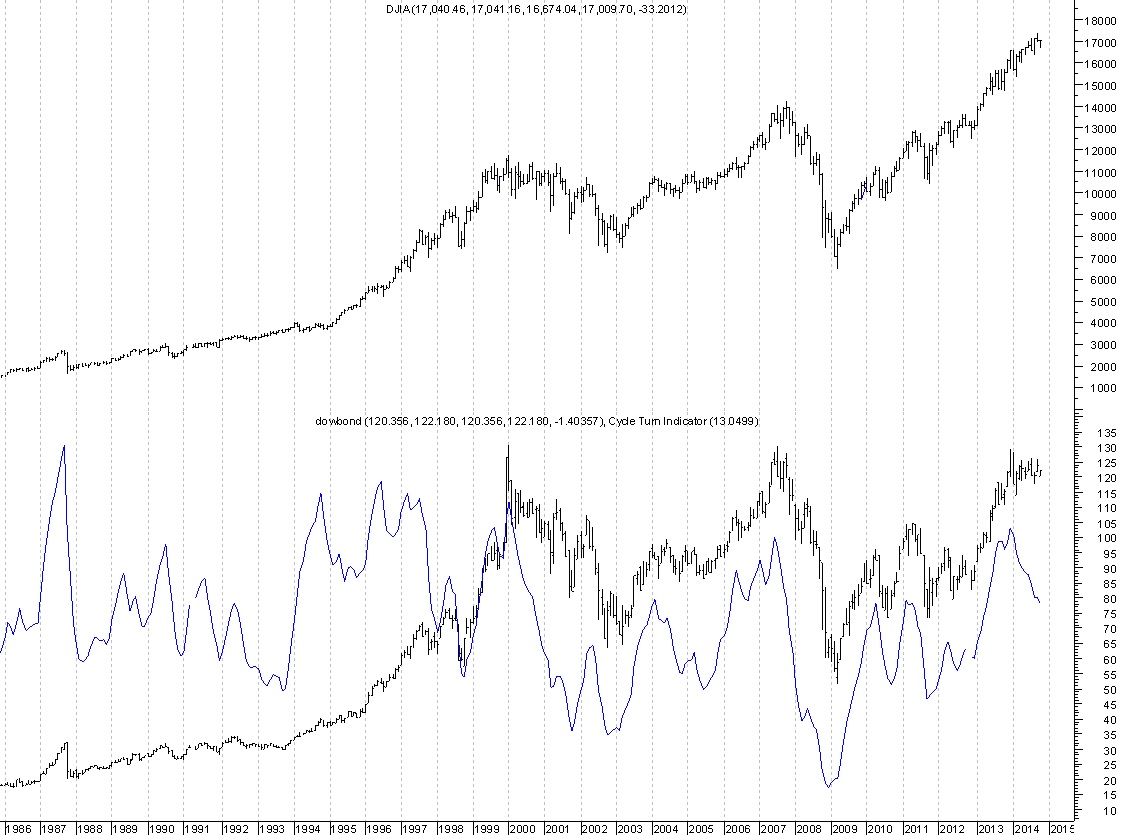

The above chart is the Dow/US T-Bond Ratio since 1986 on a monthly basis. It is simply the price of the Dow divided by the constant US T-Bond futures contract. Prior to 2000 its was generally trending up and to the right. Since then an interesting pattern has formed. It looks like we have the makings of a triple top. This ratio most recently peaked in December of 2013 (coincidently with the beginning of the QE tapering) and has been grinding sideways since. Notice the blue line which measures the second derivative strength has rolled as well. Essentially the Fed has been waging a battle against deflation since the popping of the tech bubble in 2000. They fought that deflating bubble with low rates and blew a housing bubble. The housing bubble popped in 2007 and the Fed decided to blow a new bubble with ZIRP and multiple QEs. What is the new bubble they formed this time? The everything asset bubble. How does it end? Very badly.

The chart is signaling that this bubble is coming to an end and stocks, which have been a huge beneficiary of the multiple QEs, will be a particularly huge train wreck. Bonds bottomed in price on December 31 and have been essentially moving up all year long with about an 18% return YTD. The Dow is up about 2.6% YTD. At the beginning of the year conventional wisdom was that bonds would be awful because the Fed, which had been the biggest purchaser of treasuries, was stepping away. Essentially a no brainer short. What happened? The ending of QE is very deflationary and there has been a very quiet distribution or lack of buying of risk assets which is showing up in this chart. Capital is moving into Bonds and not into stocks/risk assets. In deflationary periods US Bonds do very well. This ratio essentially measures weather or not deflation is winning. The chart certainly looks like it is getting ready to roll and that stocks will likely enter a bear market soon. Commodities are already in bear market territory and warning of deflationary forces winning the battle. The US Dollar is on a tear and it is also flashing warning signals. This ratio however has been signaling warnings since January.

If the economy was actually improving Bond yields would be rising not falling. QE ends in 4 weeks. If you think that stocks can rise without QE because the economy is getting better I will take the other side of that trade all day long. I will stick with the Bond guys. They are always smarter than the stock guys. How do I know that? In the distant past I was an institutional Bond salesman and my clients were very smart and cautious.

I am looking to short this market again soon since covering on Thursday. I can’t state this enough but we are in a very dangerous set-up right now in the stock market. My biggest fear is we crash because of the excessive leverage in the system and the lack of a meaningful correction in the last two years to unwind sentiment.

I think owning stocks at this point in the cycle is actually quite insane given the Fed’s Frankenstein distortion of this market and the pending withdrawal of QE. I believe we are about to experience a four year cycle decline which has averaged 34% since the inception of the DJIA. Since this is, in my opinion, a secular bear market then we will likely take out the 2009 low. So we are looking at a decline of somewhere between 34% and 70%. Lots of my friends who manage billions are telling me that we likely get a Q4 rally because of seasonal tail winds and performance chasing. So in case you were wondering that is consensus thinking. People may look at my stock market prediction as insanity. I get it. It is hard to believe but since most people worship Janet Yellen and the Fed I choose to be insane. Just as sure as the sun comes up in the morning and sets in the evening the stock market has experienced cycles. 2009 was dawn and 2014 is dusk. The sun is setting very soon.

If you enjoy the content at iBankCoin, please follow us on Twitter

Roles might reverse between commodities and US equities for a while.

Can commodities really go down much more with looming transportation / supply issues and certain commodities like cocoa and coffee almost guaranteed to keep going up IMO.

Commodities might be where everyone goes for yield the next year or two before it all really goes to hell.

Since you putting it out there I might as

well do the same.Canada(I know Iknow)

went throught the same correction as the

U.S.A in 1989-1993.The TSX ,housing,

jobs,monster deficits all as high or

worse than what just occured in America

When it began improving in 1994 the

same feelings of doom was all around.

But jobs brought new money , high

hopes good times for 20 years.

The U.S economy is improving right now.Keep interest rates low and I think

bobs your uncle for a long time.

Bluestar, firstly I think its great you are around as a counterpoint to what is generally a “bullish” site.

However, if you genuinely believe your thesis, I’d caution against getting too cute with predicting bounces and entry points.

If this is a genuine changing point, and you have many years of market experience, you know that once things get going in a bear market, the bus often leaves empty, with people waiting for that “one last rally” to get short.

They then get caught fearing they’ve missed the bus, and short in the hole (usually into the savage countertrend rallies that bear markets can throw up).

At some point, its going to be about getting an entry with a wide stop and leaving it there, otherwise (like many on the way up), you risk being right, but not profiting from it in the manner you have predicted.

Bunk,

You are correct sir. I had the same thought today. Too damn cute. I rolled my profits into IWM puts Nov 105. I also went short AMZN as well. I am more short now than I was last week. More later.

AMZN …Nov/dec puts??

BlueStar,

Those charts are looking your way right

now

Bill,

Shorted stock on AMZN.

from gorby,

I am not following you here?

Blue,

So you think this is a headfake from commodities and not money going from US equities into commodities?

Bruce,

That is not how it works. Commodities are price bars not assets. No one rotates like that except a small amount of speculators. Bruce deflation is looming. Equities are 2% off their highs. I fully expect the dollar to come in here for a spell. I also expect equities to sell off as well. They are the last man standing. Margin calls are beginning on a global basis. Start slowly and gather steam. I could be wrong. most peopl I know think I am crazy. Maybe I am.

BlueStar,

What I am trying to communicate is your

two shorts look fine on the very basic and simple charts that I use.

Where we part company is I think we

can have a 10-20% pullback, but if

the economy and jobs keep improving

-which I’m positive on –

earnings will catch up to valuations and we move forward for a long time. I use

the 89-93 Canadian time period as a historical model for my investing thesis. Long banks,insurance, housing etc.

Hope this helps.

I like to believe Caldaro is right, and there will be the correction in the form of P4, down ’til possibly 1400 territory, and then a P5 to finish it all and then BlueStar’s scenario plays out in a year or two.

from Gorby,

Thanks. lets see what the structure of the market looks like down 10-20%. I am not religious. we can debate about the economy all day long. price trumps all. Good luck.

Bruce,

See my post to Gorby. Lets all re-examine lower.

BlueStar – we have spent the past 4 years hearing about black swan events that will be the “catalyst” for a crash – is the Ebola outbreak (and the potential expansion) a potential slow-motion black swan that will intensify this downturn? I am not convinced it is at this point, however I would like to hear your opinion.

k_melancon,

Markets crash due to buyer exhaustion and the end of a parabolic move up. In 1987 we crashed. They pointed to the trade deficit in 1987. In reality there was no reason. it was just time and too much leverage. This advance is in month 67. 7 months beyond the other two records of 60 months in 2007 and 1987. once we start going down margin calls will accelerate. In 1929 we just crashed. the great depression started 6 months later. everyone is always looking for reasons why the market went down. The stock market is cyclical. Even if we don’t crash I think we have a nasty correction. Oh yea. Ebola is bullshit.

BlueStar – thanks – you never answer things how I think you will which is why I ask questions – I appreciate your insights

Blue,

If deflation is looming, then why would the Fed stop QE? Do you really think they will go against the main benchmark they have used since the onset of QE (i.e. ease until we see 2% inflation?). If the US looks like its going into a deflationary cycle, the Fed will step back on the gas.

Forget Alpha,

I am sorry if I misspoke earlier. Deflation is here already. It Just has not shown up in the stock market yet. Yes the Fed may do more QE. But when? Down 10%? Down 20%? etc. Do they dare do it in front of elections? What if they can’t do it? A subject for another post. What if QE does not matter once the margin clerks take control?