Sorry, your only hope is dead in a ditch after being skull-fucked by Chinese Jawas.

AMSC has quickly turned from a Star Wars story to a Dickens, but in this case it now becomes a Tale of Two Buyers. More on that in a second. This whole AMSC bit is a pretty big deal if only because a few hours ago its market cap was 1.25bln and in the coming weeks it will rapidly head towards something close to 1/6 that, like 200mln or so. That’s a lot of “value” to disappear on lack of hope.

Before getting into the issues, let me point to the second part of the original analysis I did on AMSC that I intended to post after my trip south today. It is down at the bottom of this way too long post. I wrote it a few days ago but, because I get busy during the week, thought it and a few others would bleed out as the week progressed. Clearly I should have posted it this morning instead of lashing out at BAML about batteries.

Whatever, my point is to take a look at it anyway as it is still valid. Sell-siders “blindsided” by this event will come out swinging in defense of AMSC tomorrow, likely suggesting all is well and this is something we get to gloss over like three-eyed Binky or newly homeless Japanese folk. Whether Sinovel fucked AMSC or not, the bloom was off the rose and AMSC was headed south anyway. Check it out when you are done with this.

So what are the issues? Even more margin decline, fraud, and what the hell do we do about this European company 95% exposed to Goldwind?

(I am hoping IBC in-house counsel will correct anything I say below that is incorrect.)

1. Margin Decline

Believe it or not, I am an optimistic fellow. I like to think the best of people. At the very least, it keeps my personal stress level down. In this particular case, let’s assume AMSC management was on the up-and-up and did not intend to screw anyone and still has shareholder interest at heart.

AMSC needs to do two things to stop the bleeding: fire the head of sales, and make a price concession big enough that allows Sinovel to continue holding this inventory. This immediately shifts fraud allegations to incompetent staff. Unfortunately, this staff is likely director level or above so there is probably still pending legal risk, but such risk is greatly mitigated by this swift response.

The problem with this path is that forward pricing with Sinovel is likely set to this lower, concessionary level, meaning margins are smashed going forward. While extensive legal action is minimized, stock valuation remains in freefall until management can increase guidance above estimates.

2. Potential Fraud

This one is harder to avoid as too much evidence is already in place. First, the stock cratered IMMEDIATELY BEFORE the acquistion announcement. That’s a little crazy. A big shout-out to thewife for spotting this one. Hard to get too negative on technical analysis in this case.

Second in the potential fraud category will be a little harder to prove, but the evidence is in place there, too. It becomes a question related to sell-in and sell-through and revenue recognition. If prior quarter revenue recognition is in question, it suggests AMSC sold something to Sinovel that has not yet been consumed by Sinovel, or in a better light, has been consumed by Sinovel in the form of a wind project but Sinovel has not yet been paid for said wind project. The knots in either case are mind boggling and not easily unraveled.

3. Dead Deal

Ah ha! The original meat! How much cash is needed? In this case we are directed back to “Original AMSC” when considering whether the “The Switch” acquisition can be completed.

Let’s start with the idea this pre-announcement occurred BEFORE the acquisition announcement (does this lead to a THIRD potential fraud allegation?). What would AMSC’s cash situation look like if Sinovel forced lower pricing on AMSC two months ago? Hard to say exactly, but Consensus estimates show us expected EPS on 40% gross margin – what if it were 25% gross margin? For existing shareholders it is a horrific thought, and one likely leading to a much lower multiple. A multiple in-line with current alt energy stocks (5x-10x) on $1.15 leads to something between $6 and $12. Suddenly, dilution is a material issue as something between 10mln and 20mln shares are required to complete the acquisition – assuming you can find enough investors to shell out that kind of cash for a management team of questionable morals.

More than likely, something closer to 20mln shares will be required to complete this deal. Current diluted share count is 49mln. The best thing AMSC could do is to offer and price a deal in the next few days on a $15 share price. This would keep dilution to less than 7mln shares. If we get to next week and there is no offer, AMSC will need something 3x higher to complete the acquisition. While there may be significant short covering tomorrow, expect shorts to come back with a vengeance if an equity offer does not materialize soon.

Okay, there are the issues. Who’s going to buy this pig?

Two folks are going to buy this thing. Well, three actually, but day traders don’t count. Short sellers and value investors are the only ones buying in size. This is the reason AMSC needs to strike a stock offer quick.

Fundamental short sellers are weird motherfuckers. Even when a stock goes the wrong way on them they add to positions. It takes a lot of pain to shake out a short. Flip into this particular situation, and these Citronellas are laughing themselves silly, magnitudes away from a pain level inciting them to cover. When these guys smell blood, they add to short positions if it is available. Any sort of short covering occurring tomorrow morning are the weak shorts.

And then you have the value investors. They have no idea what a chart looks like. Time piecing one price to another is not a concept available to their brains. They trust Mother Deloitte, and anything 20% less than expected value is fair game. Let me tell you, there is a sick amount of cash available for these guys to chase down targets.

In essence, short sellers are the evil twin of value investors. Think Michael Keaton in Beetlejuice. These are the folks who will determine the real bottom in the stock.

Let’s help out with a couple of possible valuation possibilities:

- 12x FY12 EPS = $13.80

- 10x FY12 EPS = $11.15

- 5x FY12 EPS = $5.75

- 1x c4q10 tangible book = $9.10

- 1x c4q10 tangible book minus questionable receivables = $8.10

Divide through by 1.2

- 12x FY12 EPS = $13.80/1.2 = $11.50

- 10x FY12 EPS = $11.15/1.2 = $9.30

- 5x FY12 EPS = $5.75/1.2 = $4.80

- 1x c4q10 tangible book = $9.10/1.2 = $7.58

- 1x c4q10 tangible book minus questionable receivables = $8.10/1.2 = $6.75

Given current valuations of comps, “tangible book minus questionable receivables” looks to be a worst case near term. Best case is that someone drinking koolaid starts buying at $13.80. If you are short, look for a bottom between $7 and $14. With the stock trading close to $15 after hours…this thing ain’t done yet.

_______________________

Back at AMSC, this time with better details. Let’s take it in stages by first looking at guidance given at the Q4 report, then updated guidance given after the acquisition of “The Switch,” then at margins for the combination.

FQ3/CQ4, Feb 2011

“We expect to end our fiscal 2010 with another quarter of sequential revenue growth and strong profitability,” said David Henry, AMSC’s senior vice president and chief financial officer. “For the full year, we continue to expect revenues in the range of $430 million to $440 million. However, we are raising our net income forecast for the full fiscal year, which we expect will enable us to more than offset the dilutive effect of our recent stock offering on our earnings per share. Our net income forecast is being increased from a range of $44.0 million to $46.5 million, or $0.95 to $1.00 per diluted share, to a range of $48.0 million to $50.0 million, or $0.99 to $1.04 per diluted share. We also are increasing our non-GAAP net income guidance from a range of $60.5 million to $63.0 million, or $1.30 to $1.35 per diluted share, to a range of $64.5 million to $66.5 million, or $1.33 to $1.38 per diluted share.”

OK, so this refers to fiscal 2010 which ends in March 2011 for them. I hate that. Grow some balls and report like non-Japanese big boys, you’re making money now you idiots. Whatever, this raises guidance while also burying a slightly higher share count.

Regarding the almost non-existent superconductor sales: “We’ve talked about the revenues there starting in 2012.” Hmmm, perhaps you have spoken about that, but I recall you also talking about such sales starting in 2010, and in 2011. You can almost touch it…I’ll put it in my model next year.

The Switch Aquisition, Mar 2011

In conjunction with today’s announcement, AMSC is updating its guidance for fiscal year 2010 (ending March 31, 2011). The company expects that its revenues will be toward the lower end of its $430 million to $440 million forecast range. Due primarily to anticipated one-time costs related to the acquisition, AMSC is reducing its net income guidance from a range of $48.0 million to $50.0 million, or $0.99 to $1.04 per diluted share, to a range of $44.0 million to $46.0 million, or $0.91 to $0.95 per diluted share (see table at end of this press release for details). The company’s non-GAAP net income guidance is being reduced from a range of $64.5 million to $66.5 million, or $1.33 to $1.38 per diluted share, to a range of $63.5 million to $65.5 million, or $1.31 to $1.35 per diluted share. Please refer to the financial table included below for a reconciliation of GAAP to non-GAAP guidance.

Huh. Didn’t you just raise your guidance? And trying to call this a result of The Switch acquisition won’t work because sales are lower. And doesn’t your non-GAAP silliness exclude such inconsequentials like acquisition costs? Basically, in the span of a month something bad happened to dunk your quarter back to your original guide. It’s getting a little stinky in here. Moving on.

“We expect to achieve another record year of revenues and earnings in fiscal 2010,” said Yurek. “However, AMSC’s organic revenues and earnings are expected to decline sequentially in the first quarter of fiscal 2011 from the fourth quarter of fiscal 2010 before growth resumes in subsequent quarters. For full fiscal 2011, we expect organic revenue growth to slow to about 5 to 10 percent year over year before increasing again in fiscal 2012. We also expect our organic non-GAAP earnings per share to decline by as much as 15 percent year over year due to a higher share count, somewhat lower gross margin related primarily to product mix, foreign exchange headwinds, and a full year of dilution from minority investments.

OK then, things clearly suck for AMSC. While it looks like new estimates are populated, the stock arguably has not responded…but it does look like the word got out ahead of the acquisition given the severe dive the stock took immediately before the announcement. No front running here, just us chickens. Moving on once more.

Back to estimates, the stupid non-GAAP Mar12 estimate is now 1.15, 13% lower than a few weeks ago. But margins are barely changed. Let’s look at margins, shall we?

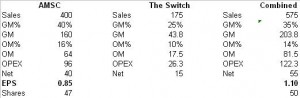

We will be charitable and skip FY12 and move right to FY13. Let’s just forget FY12 ever happened even though it is only six days old. Not only that, we will keep share count unchanged for the bulls. Combining the two companies and using GAAP for AMSC, we get the following chart:

Add 30c for that stupid non-GAAP adjustment and you get 1.40 for the combined company…assuming no change to share count. This compares to the present FY13 Consensus of 542mln/38%/1.38 on 50mln shares.

Well now, this is cooking with gas. We know share count must go up, and we know gross margin must come down. Basically, whichever EPS estimate you look at for AMSC, it is about to flatline for at least two years…best case. With a current year multiple approaching but not quite in the stratosphere, this thing could be just about cooked. Look for margin estimates to walk down over the coming quarters along with the expectation of yet another equity offer to push this thing lower. Of course, as with any pending offer, be careful of traders pushing the stock higher in an effort to win banking business.

11 Responses to “Help Me Obi Wan!”

MOOBER

Wow. I wish I had your brain. Terrific analysis. Bold call. Pure tiger blood.

scott

Terrific call. What else can one say?

The_Real_Hmmm

Nice valuation analysis. Allow me to add some comments. Through my brief reading about AMSC I’ve found that they have binding contracts with Sinovel whereby they provide engineering design as well as electrical/mechanical components that drive the equipment. Their margins on the design side are negligible but the component side is where they generate their lion’s share of revenue.

Now here’s the catch- AMSC implements heavily encrypted software and proprietary intellectual property whereby AMSC wind turbine designs can only use AMSC parts. In emerging markets they can’t enforce certain patents and as a result AMSC uses constantly updated software to keep the hooks in their clients. The public statement yesterday reads that “…Sinovel refused to accept contracted shipments of electrical components and spare parts….and they BELIEVE that Sinovel intends to reduce its inventory level before accepting further shipments.”

I’m a bit leery of AMSC’s so-called belief that Sinovel intends to reduce inventory. We know that when you deliver a product it must go through design, specification, manufacturing, etc. stoking the supply chain as it nears shipment. I don’t know but I’m guessing that because of their heavy proprietary and skeptic nature and the necessity to pair design to components through software, that there wouldn’t be excess inventory of parts laying around. Therefore, I would read AMSC’s statement more clearly as Sinovel is not buying our components AND designs, which is even worse. Who knows what that contract reads though.

Just some thoughts.

Master Fly

Nice chequemate.

I am sure you wish you had more time to build a position. This was a year making call. You can now miss 3 in a row and still be gold.

Analyst Bomber

Indeed, but my suspicion is that there is still time to get a good chunk of this thing. People are stupid and will buy the dip.

The Equalizer

It’s a testament to the state of the industry that two reports – the second of which opened with the phrase “skull-fucked by Chinese Jawas” – provides the reader with a more detailed, understandable, and accurate financial model than most of what the sell-siders were able to come up with.

Incredible work, AB.

thewife

Thanks for the shout out AB.

Indie

let me add to the consensus and mention how top class act this analysis is. an inspiration. keep up the good work.

The Idiot

Huzzah!

GYSC

This is freaking amazing. Re AMSC and a Star Wars quote, try out:

“We are quite safe from your pitiful little band!”

If you had really been on point, it would have looked like this « ducati998

[…] in a follow up post, still doesn’t really get it: anyway, the problem was there, and easily […]