I’ve always believed that crashes are fairly predictible because human nature is fairly predictible.

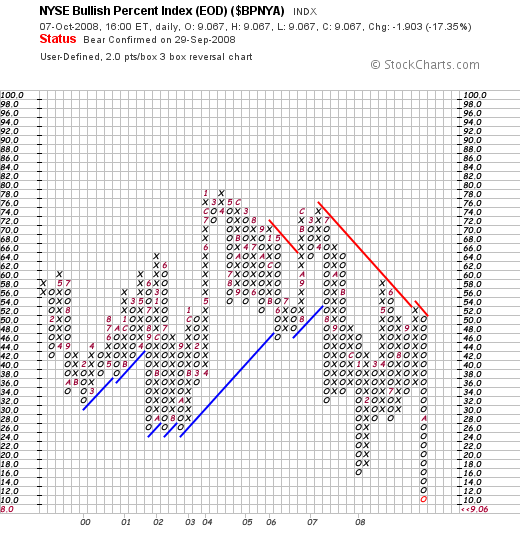

This market is setting up for a crash on Monday. Trust me.

This will be the third market crash of my investment career. A trifecta.

I think this one is mirroring the Oct ’87 crash. We shall see.

Regardless. I do agree with the Fly that tomorrow will be down, which sets up Monday, October 13th as “the day”. Besides how much more unlucky can you get than “13”?

So far the “crash” has been more of a slow motion train wreck. We need to have that one big final panic day. It should be over 1,500 points down on the Dow, or it’s not legit.

Trust me, so far it’s been mainly the hedge funds, pensions and institutions that have been the main participants in this egregiously big sell off.

The Fly may call the brokers idiots, but one thing they do is prevent their clients from getting out when the market is down. In spite of that, eventually, the public just can’t take it anymore, and they sell everything. They get out, then fire their broker.

I think we are nearing that point.

We all know that the average investor actually buys high and sells low because they never really understand the risks of the stock market. They let their emotions rule instead of logic. They’re always the last ones to get in, and the last ones to get out. Always. Call it destiny or whatever.

Now they are starting to get out, no thanks to their brokers.

I now expect the bank stocks to rally into the end of the year and into the New Year. But I’m waiting until next week to see how Monday turns out before taking Comrade Hank’s advice to buy them.

I’m spending the next few days pouring over stocks—blue chips, heavily beaten down names that are paying good secure dividends. General Electric Company [[GE]] is one that comes to mind immediately.

Maybe I’m wrong about all this. Then again, maybe I’m not.

Comments »