“….you have to maintain a cautious approach to stocks. My current allocation is…”

To the average person, the stock market is like a big riverboat gambling establishment, laden with con men and fraught with risk. And yes, there is certainly plenty of risk, as we have so acutely been made aware of these past 12 months—-in spades.

How does one invest or trade in this current market environment?

Here’s what we know:

1. The stock market is a leading indicator of the economy. It typically turns 6 months, on average, before the economy. There are other leading economic indicators (LEIs) as well, that can give valuable insight as to the plight or the strength of the economy.

2. The economy is in recession.

3. The financial system is in crisis mode.

4. Government policy makers are battling deflation.

5. Corporate earnings are falling.

6. Commodity prices are dropping.

7. T-bill yields are essentially at zero.

8. Consumer confidence is at multi-decade lows.

9. Market sentiment is very bearish.

So, what’s the game plan here? Short the crap out of everything and join DevilDog at his palacial hellhole for a hearty laugh and some brew? I think not.

When you look at the data, if this recession is comparable to the one of 1973-75 or the double dip in the early-1980’s, we can expect GDP to drop at least 3% -5% before we hit bottom. So far, we have a revised number of -0.5%. So expect things to worsen. Oh, joy.

So….how bad is it?

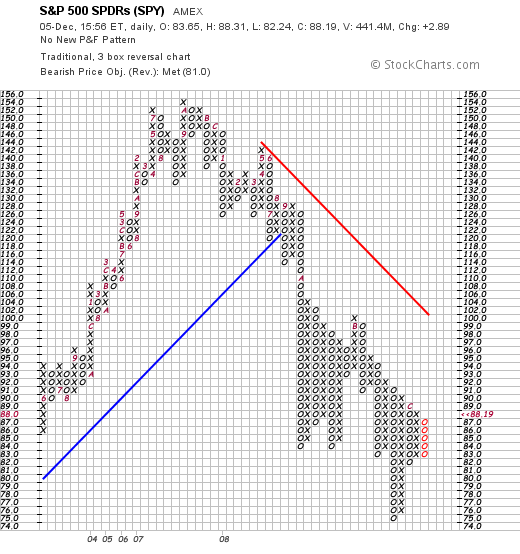

It is rather obvious now that investors are as bearish on the stock market as they’ve ever been. Look at T-bill yields. They’re basically zero. Credit spreads (BAA bonds vs. 10 yr Tsy) are over 600 basis points. And, the S&P 500, after 290 days from its peak last October 2007, has declined by a higher percentage than the 290 days after the Crash of ’29.

So yeah, it’s negative out there.

What’s made all this so bad is that when you factor in Household and Financial Debt, combined, as a percentage of GDP, we have exceeded well over 100%. This comes at a time when the value of the assets backing all that debt has dropped precipitously. Yikes. This much we know.

When the Japanese Nikkei went “ka-bust” in 1989, houshold + financial debt was well over 100% of their GDP. This fact is a source of great concern, because this is where some of the analogies and projections for the U.S. are coming from.

We also know that banks are guzzling down huge vats of losses. The global writedowns are now at over $1 Trillion, with the U.S. responsible for about 2/3 of that (and counting). Remember a year ago, when Benanke said that this thing was “contained” and the pundits estimated $250 – $300 billion of write-offs? Yeah, that’s right. They made a mistake. Nobody’s perfect.

Banks have tightened their lending standards to shore up their balance sheets, companies are having trouble getting extensions of credit and capital expenditures are getting slashed. Access to capital is still restricted to consumers, who make up 70% or so, of GDP. In addition, the labor market is weak and will probably continue to show more weakness.

Now, for the first time in about 8 years, we’re seeing the individual savings rate approach 3% of income, so not only are the banks hoarding cash, so are consumers. Hello! Deflation is now here, folks. This makes sense, as the cash assets on bank balance sheets are spiking higher as people seek cover under the umbrella of the FDIC.

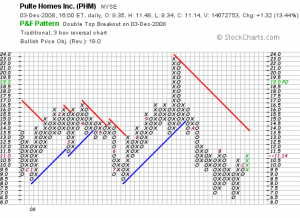

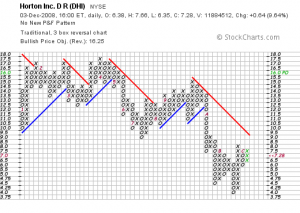

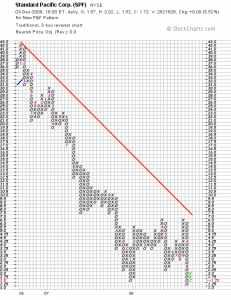

Why is this deflation so bad, you ask? What’s wrong with lower prices on gasoline, food, energy and consumer goods? The problem is that deflation SEVERELY restricts an enterprises ability to generate income. In a highly leveraged environment, this becomes a problem for obvious reasons. Hence, we are seeing what we all have come to know as a massive delevering in the economic cycle. Lower income means lower earnings; and lower earnings means lower a lower stock market—-unless you live in a bizzaro world.

The bond market has reacted appropriately to this serious threat. It is real. A deflationary spiral turns a recession into a depression, and with the velocity at which money flows, it can slow almost as quickly. The risks of a depression remain.

That said, you have to maintain a cautious approach to stocks. My current allocation is 24% cash, 21% bonds and 55% equities. The cash portion is used to hedge, via iETFs. The bonds are munis and the stocks are the ususal suspects to own during a recession: utilities, drugs, telecomm and consumer staples. That’s it right now.

I would not be adding to stocks at this point until I see the economic numbers start to turn favorable for the economy. Should things worsen from here, I would deploy cash in hedges, selling lagging stocks, and buying more bonds. If the threat of a depression increases, you gotta go with Treasuries, as retarded as that might sound. Are bonds in a bubble? It appears so, but yields can go lower as people pile into them if things get really bad.

Sometimes the strategy during these times is to win by not losing.

Comments »