Good on you all. I won’t recap 2008. What’s the point? The year has been sliced, diced and analyzed ad nauseum. If the asshats in the media use the word “unprecedented” one more time, I’m going to cancel my free subscription.

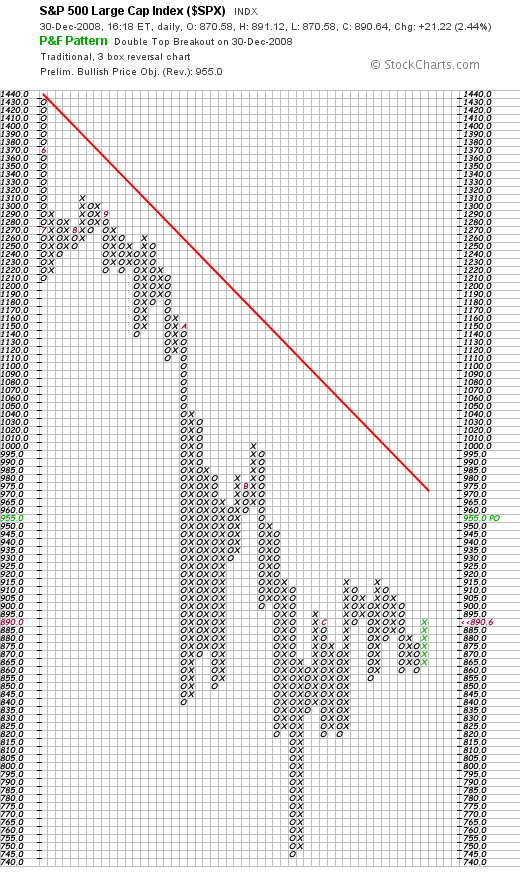

The market looks like it’s setting up for a potentially nice rally that could take us back close to 10k DJIA. However, I’m waiting for better confirmation of that possibly today and into next week before loading up (albeit nervously).

That said, there is a cornucopia of things that can sink the market again this year. While some people have been talking of a recovery in 2009, I staunchly believe that is premature. Sorry, no “V-bottom” is in the cards. Just more pain….and suffering. However, that doesn’t mean that the market won’t rally. Hey, traders have to make a living. Someone has to push the market back and forth.

As I alluded to, lots of things can go wrong—and probably will. Joe Biden even said so.

[youtube:http://www.youtube.com/watch?v=IpiNfuG8YY8 450 300]Here’s one: the Israel / Gaza thing is escalating and could incite Iran and other Israeli-haters into action. Just know that Israel is very close to attacking Iranian nukular [sic] facilities, possibly within the next 30 days. With Iran getting close to nuclear warhead capabilities, not only is there a threat to Israel, there is a very real threat to the U.S. which has been discussed and analyzed now for several years. I’m talking about an “E-bomb”. Were one to be deployed successfully against us, or any other country for that matter, by Iranian-backed terrorists, the economic meltdown would make 2008 look like the good ol’ days, not to mention the death, disruption and social chaos.

Oh yeah, Happy New Year.

Comments »