We will know by the end of this week whether this rally will continue. By some measures, the markets are getting into overbought territory. Of the stocks traded on the NYSE, almost 72% of them are now trading above their 50 DMA. In addition, 64% of the stocks in the S&P 500 are on PnF buy signals. That number is 76% for the Nasdaq 100. So, if you’re adding to long positions, or thinking about getting long now, be advised.

As far as sectors, insurance, steel and machinery look like they’re getting into overbought territory.

There are nine, count ’em nine, economic reports scheduled to come out this week, the most important of which is the employment report, which is actually made up of five economic measures: initial jobless claims, average workweek, hourly earnings, nonfarm payrolls and the unemployment rate. These are scheduled to be reported starting on Thursday with initial claims, then the rest on Friday.

Given the wealth of data contained in the employment report, it is important to take all of these indicators into account when passing judgment on the report. Looking at payrolls alone, is often misleading, as the workweek, earnings, and household employment measures may be telling a different story. Taken together, however, and taken with the caveats concerning monthly volatility and revisions, the employment report offers the best monthly glimpse of the economy.

Look people, the bad news is out. Any, and I mean any, indication of improvement in the employment situation will most likely drive this market much higher. Traders and investors are looking for any excuse to keep this rally going. I can’t say that I blame them. However, one must be careful about putting too much weight on one week’s report. There is still much to be concerned about on a global scale, including the developments in the Middle East.

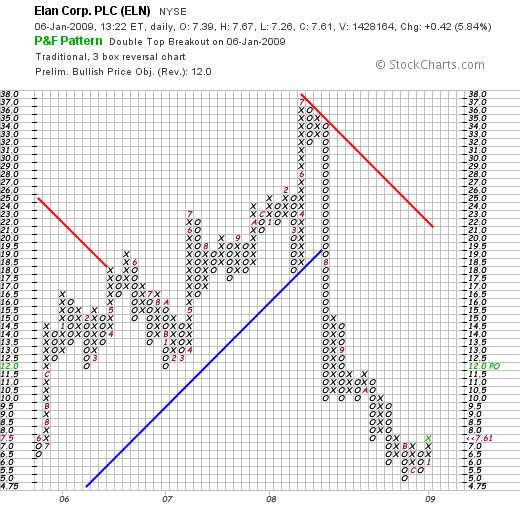

On a technical “big picture” note, my PnF charts are showing an interesting development. As of Friday, almost five times more stocks are showing bullish breakout patterns, versus bearish breakdown patterns. The week before last, there were twice as many stocks still in breakdown patterns versus breakout patterns. That was out of over 3,200 stocks. Five times more bullish patterns than bearish patterns in this environment might be a contrarian indicator to short this market. We shall see.

Holdin’ out for a sign this week.

[youtube:http://www.youtube.com/watch?v=xfT0BMiuCjs 450 300]

http://www.youtube.com/watch?v=xbQKiW0xLwM

(Sorry for the link, but the embedding function went all queer on us)

Comments »