Sentiment Continues to Fall

A quick glance at the sentiment numbers illicits an “oh, shit”, response.

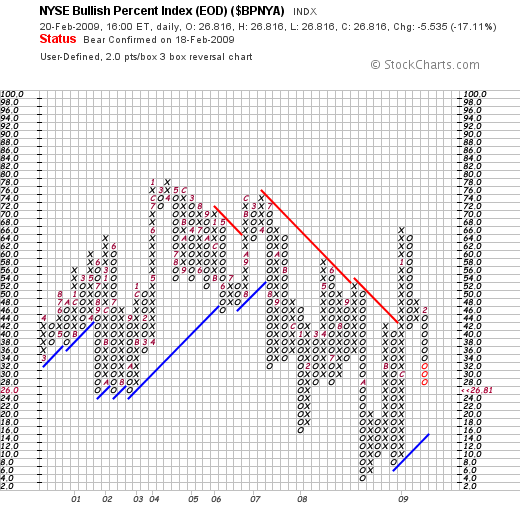

The NYSE Bullish Percent continues to fall and has now breached the 30% level, closing at 28% on Friday.

However, as can be seen from the chart, there is still more optimism, than the lows of November, when the Bullish Percent was an extremely oversold 4%. Is there more downside coming? This is one piece of the puzzle that might be confirming a resounding, “affirmative!”.

In addition, the S&P Bullish Percent and the Nasdaq Bullish Percent both hit sub-30% levels on Friday, and both are similar in that they are also indicating more optimism now than in November. But, have things really gotten any better to substantiate that? Uh, no.

The ratio of New Highs to New Lows is now sitting at only 6% for both the NYSE and Nasdaq, and that number has been steadily falling.

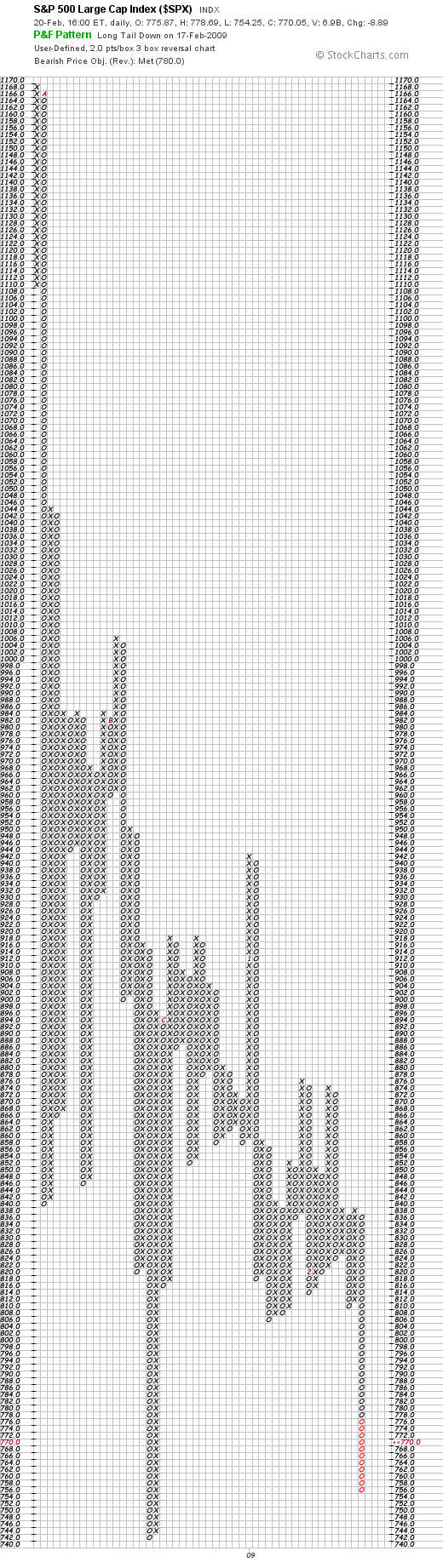

That said, with sentiment so negative, a possible bounce could be coming, at S&P 741-742.

Or, we could crash this week, as some might be thinking. However, there is always the possibility of a profitable Costanza trade were that to happen. So, get ready to play the bounce with a few of your shekels if the opportunity presents itself on a big down day this week.

Comments »“Hey, We’re Working On It Already” —-Barry O.

Ever wonder why Geithner was so vague last week? Read on…………

London Times, February 19, 2009——-

“President Obama was hit with another wave of grim financial news yesterday, amid signs that his Administration is in danger of being overwhelmed by the scale of the economic crisis.

As he outlined a $75 billion (£52 billion) plan to halt home repossessions across America, evidence emerged of the enormous struggle Timothy Geithner, the Treasury Secretary, is having to come up with a detailed solution to stabilise the stricken banking sector.

Chrysler and General Motors also said that they needed up to $22 billion more in government funds to avoid collapse, leaving Mr Obama the difficult decision of whether to keep pumping taxpayers’ money into the carmakers.

The motor industry received $17.4 billion in federal funds in December. Its bankruptcy could cause millions of job losses. Mr Geithner and Lawrence Summers, the White House economic adviser, must determine by March 31 whether the companies’ plans for long-term survival are viable.

At the heart of the internal battle inside the Treasury Department is what to do with the estimated $2 trillion of toxic and mostly mortgage-related debt that is threatening to topple the entire banking sector – the bedrock of US capitalism.

When Mr Geithner announced his plan to stabilise the financial sector last week it was received badly because it was so short on detail. The heart of the strategy – his prescription to remove the bad debt off the banks’ books – was to entice private investors to buy up the toxic assets. He gave no firm proposals, however, about how the loans would be valued and how the private sector would be co-opted.

It has now emerged that Mr Geithner was deliberately vague at his press conference because he had a change of mind and suddenly began to pursue a different course.

He decided that his original plan to use government funds to buy up the toxic assets was too expensive and exposed taxpayers to too much risk, and that using the private sector was the best option.

At the same time Mr Geithner is working on the plan with a significant shortfall in staff. Only a month into his presidency Mr Obama has yet to nominate any mid-level Treasury officials.

Other departments – some still even without a Cabinet secretary – are about to be inundated with billions of dollars from the stimulus Bill signed by Mr Obama on Tuesday but with not enough staff to determine how to spend it.

Alan Greenspan, the former Chairman of the Federal Reserve and once the leading proponent of deregulation and less government in the markets, increased pressure on Mr Geithner yesterday when he said that a temporary nationalisation of some banks could be necessary. He called the crisis in the banking sector a “once in a hundred years” event.

Mr Obama’s home foreclosure plan would allow many of the nine million Americans who are threatened with eviction to refinance or restructure the mortgages to reduce their monthly payments. He said that his plan was needed to avoid “even greater havoc”.

The President said that the home repossession crisis “is unravelling homeownership, the middle class and the American Dream itself. But if we act boldly and swiftly to arrest this downward spiral, every American will benefit”.

In other good news, Denninger is talking about a possible Crash scenario on Monday….

Comments »Cliffhanger

Can things get anymore precarious than this?

Can things get anymore precarious than this?

I had gone into today thinking to myself that the S&P had to hold 779 or we could fall off a precipice. It closed at 778.94. Was that some kind of sick climbing dude joke, or what?

In addition, The Mighty Dow had to hold 7440, which it did, closing at 7466.

So, here we go into a Friday, hanging right on the precipice of another potentially big sell-off. At this juncture, the bulls need a miracle in order to avert additional sorrow.

On a more personal note, thankfully, my hedges are working. My global macro trading account using ETFs was up 2.8% today thanks to some magic performed by SRS and SKF. Although I took profits in both, I’m still retaining half the original positions, with cost bases of $74.01 and $165.98, respectively. We shall see how the overnight news develops and what the opening is like tomorrow before deciding on whether to sell them or add more.

Comments »Bought SKF @ $165.96

9:41 ET

Comments »ETF Alert: New Buys and New Sells

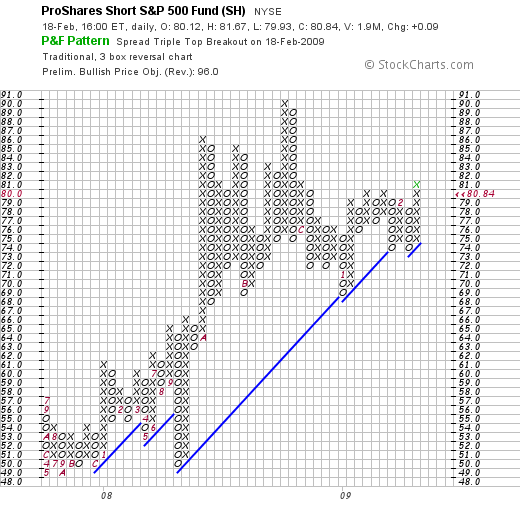

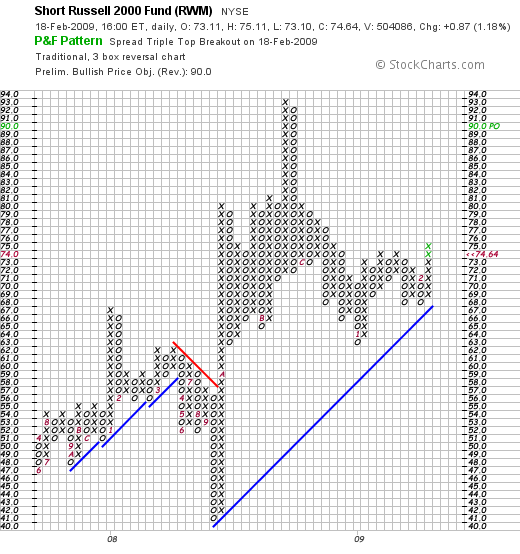

The following ETFs gave new BUY signals today based on PnF chart analysis:

New SELL signals triggered today include:

EEM, EWA, EWC, MDY, XHB.

Some ETFs still on a sell signal include:

PGX, TAN, TBT, and XLB

Just a heads up in case you’re following these.

Good night.

Comments »